I recently watched a video of a Bruce Springsteen concert where he stated that he and John Fogarty were ‘going to take a ballpark swing’ at singing a Roy Orbison song ‘Pretty Women’.

I interpreted this to mean that they were going to have a go at singing this famous song as well as they could and hopefully, this version will be somewhere in the ballpark and be as good as the original.

In this article, I am going to take a ‘ballpark swing’ in hypothesizing, on an informed and insightful basis, how the QBCC will regulate three key SOP initiatives in 2022.

It’s not all guesswork on my part!

I have read many public record documents that provide guidance and insight on the approach the QBCC will adopt in this regard. Furthermore, I have really ‘leaned in’ to this task because I think it is very important for contractors to think about the case I will be laying out for them to consider.

How close I come to accurately forecasting the actions of the QBCC will be something I will revisit in 12 months.

As the inaugural Compliance Manager for the industry regulator (QBSA/QBCC), I was heavily involved in the development of the initial version of the Minimum Financial Requirements (MFR) for licensing and was then responsible for their implementation in 2000.

I was responsible for overseeing several thousand investigations into financially distressed contractors under the MFR over the subsequent several years.

During the 22 years I worked for the regulator, I also undertook SOP research, wrote discussion papers, developed policy, gave drafting instructions for legislation (Building and Construction Industry Payments Act 2004), and gave evidence at a Royal Commission and a Senate enquiry into insolvency in the industry.

Since joining Helix Legal several years ago I have written many articles on two key SOP initiatives encompassed in the Building Industry Fairness (Security of Payment) Act 2017 (BIFA), namely:

- Progress payment requirements; and

- Statutory Trusts.

Furthermore, I have also written numerous articles on the MFR for licensing, another SOP initiative. MFR for licensing is outlined in the Queensland Building and Construction Commission (Minimum Financial Requirements) Regulation 2018.

I believe I am suitably experienced and knowledgeable to offer views on how I believe the QBCC may regulate these three SOP initiatives in a broad and targeted manner during 2022.

1. Progress payment requirements.

Background.

The first thing I will say is that the industry has been on notice since February 2020 as to the broad regulatory approach that the QBCC will adopt in this regard.

In introducing the BIFA amendments on 5 February 2020, the responsible Minister stated:

‘Clause 78 of the bill establishes an approved audit program which the commission can use to check for compliance with the BIF act—not just the Trust account requirements but progress payment and adjudication matters as well.

A person who has been asked to supply documents under an audit will not be able to withhold the information on the basis that complying with the requirement might tend to incriminate them or expose them to a penalty.’

The Explanatory Notes for these BIFA amendments states that concerning clause 78 (now new section 189 of BIFA):

‘New Section 189 provides the commissioner with the ability to approve an audit program under which the commission may audit compliance with this Act. The ability to approve an audit program has been transferred from the Queensland Building and Construction Commission Act 1991 and appropriately expanded. The program must be published on the QBCC’s website. This will assist the QBCC in their role of enforcement and monitoring.’

What has the QBCC published?

In December 2020, the QBCC published a Regulatory Guide-Security of Payment Reforms (Non-Trust Provisions) where it is stated that there will be three ways in which non-compliance with SOP obligations are likely to come to the attention of the QBCC, namely:

- Reactive investigation following receipt of complaints or other incoming information;

- Proactive investigation of suspected non-compliance; or

- Proactive audit under an approved audit program.

Has the QBCC used these proactive audit powers concerning progress payment requirements?

I am aware of one such audit as at the date of publishing this article.

In a publication on the Master Builders Queensland website dated 11 December 2020, it is stated:

‘The QBCC is in the process of auditing contractors to check compliance with their obligations in respect of payment schedules under the BIF legislation. The audit program covers both builders and trade contractors.

The focus is Category 2 licensees who have not had a moneys-owed complaint or adjudication in the past 18 months. Category 2 licensees ($3 million to $12 million annual turnover) appear from the QBCC data to have the highest proportion of moneys-owed complaints suggesting that this category is at a higher risk of failing to comply with payment schedule obligations. By focusing on licensees who have not come to the QBCC’s attention recently for payment issues, they expect to be able to ascertain the underlying rate of (non-)compliance within that cohort.’

I can only presume that the QBCC did not detect any significant issues because there is no mention in the 2020/2021 QBCC Annual Report of any progress payment regulatory actions arising under section 189 of BIFA.

I am hoping that any minor non-compliance issues identified were addressed on an educational basis.

Prediction.

In 2022, I expect that the QBCC will undertake many proactive audits of progress payments as a means to obtaining a good indication of the level of industry knowledge and compliance concerning these BIFA fundamental payment protections.

Such an approach will allow the QBCC to develop tailored contractor educational information.

While I support such an approach, I sincerely hope that the QBCC has regard to the imposition such audits will have on contractors in responding.

The information sought should be essential and not ‘nice to have.’ I note that the information sought by the QBCC in the above-mentioned audit is very extensive and comprehensive.

Furthermore, as outlined in the QBCC Annual Report for 2020/2021, I expect that the QBCC will continue in 2022 to utilise section 104A of the QBCC Act to investigate alleged progress payment offences on a reactive basis. Put simply, this means that the QBCC will respond to matters brought to their attention.

Finally, concerning the third way progress payment non-compliance matters may be brought to the attention of the QBCC, I note the following statement in the relevant regulatory guide:

‘The QBCC may initiate proactive investigations when a person has an active, usually time-constrained, obligation to do something or provide something that the QBCC has visibility of.’

The obvious matter of this nature is to do with an adjudication decision.

- Section 88(6) requires that the adjudicator must give the Adjudication Registrar a copy of their decision at the same time they give a copy to the claimant and respondent (section 88 (7)).

- Section 90(2) necessitates the respondent paying an amount if so decided by the adjudicator.

- Section 90(3) requires the respondent on paying the adjudicated amount to the claimant, to notify the Adjudication Registrar within 5 business days after doing so and in the process, provide the Registrar with evidence the payment was made.

I can think of no better example of a person having ‘an active, usually time-constrained, obligation to do something or provide something that the QBCC has visibility of.’

Respondents with an obligation to pay an adjudicated amount, you have been warned!!

2. Statutory Trusts.

Background.

Please see the information I have summarised under the background comments for progress payments above as it applies here to Statutory Trusts. Furthermore, additional relevant comments are outlined below.

The QBCC now has very significant trusts oversight responsibilities. This was not the case with the former Project Bank Account regime.

In the Explanatory Notes supporting amendments to the BIFA Act, it is :

What has the QBCC published?

The QBCC has produced a Trusts regulatory guide where it is stated that there will be three ways in which non-compliance with SOP obligations are likely to come to the attention of the QBCC, namely:

- “The first is through complaints being made to the QBCC in relation to a contract that requires a Trust account. On receipt, QBCC will assess the complaint for possible further investigation and action in line with its usual processes. Other relevant notifications of non-compliance to the QBCC (such as money owed complaints or unpaid adjudication amounts) may also trigger an investigation.

- The second way is through the conducting of a proactive audit under an approved audit program. QBCC is developing an approved audit program to check compliance with Trust obligations. The program details, including purpose and timeframes, will be published on the QBCC website once finalised. The QBCC also has the power to appoint a special investigator to investigate a person’s compliance with their statutory requirements in relation to Trust accounts, and may detect noncompliance as a result of such an investigation.

- The third way non-compliance is likely to be identified is in reviewing account review reports. Account review reports are required to be submitted annually to QBCC for retention Trust accounts, and may also be required by the QBCC for project Trust accounts. An independent auditor will prepare the account review report and is required to report any non-compliance they identify in auditing the Trust account.

Because there is a possibility that failure to open a Trust account is more likely in the private sector, the QBCC may direct focused attention to that sector in attempting to detect those contraventions.”

Has the QBCC used these proactive audit powers concerning Statutory Trusts?

Statutory Trusts under chapter 2 of BIFA have progressively been rolled out since March 2021.

A section 189 BIFA notice (second way mentioned above) has recently appeared on the QBCC website.

Head contractors acting as Trustees and who opened a Project Trust Account between 1 March 2021 and June 2021 will be the subject of an audit for one Project Trust Account chosen by them over the period 1 November 2021 to 25 February 2022.

As stated in the notice:

“ The scope of the audit covers compliance with all sections of the BIF Act 2017 that refer to recordkeeping and administration of the Project Trust Account and includes, but not limited to, the following:

- Timeliness of necessary notifications

- Completed bank reconciliations

- Compliance around the administration of the deposits and withdrawals to and from the Trust account

- Administration of Trust documents compliance.”

Prediction.

Quite simply the QBCC will utilise all of the means outlined in the relevant regulatory guide and stated above, concerning the identification of Trusts non-compliance.

3. MFR for Licensing.

The current MFR Regulation was introduced on 1 January 2019 to help ensure contractors have a strong and financially sustainable business with an appropriate level of working capital.

The objective of these requirements is to reduce financial failure, liquidations and bankruptcy within the industry and ensure that people are paid for their work.

I am a strong supporter of the MFR but I am acutely aware of their limitations. An article I wrote three years ago entitled “An effective licensing regime is not a silver bullet for the problems of the industry “…..but we must have one best sums up my views in this regard.

Helix Legal has various online MFR courses to assist persons to understand their current obligations and responsibilities.

While the MFR has changed over the years, the legislative framework they operate within has not.

The following sections of the QBCC Act are the most relevant MFR legislative provisions, namely:

Prediction.

The QBCC will continue to regulate the industry through the MFR much the same way they have now done for over 20 years, in the process relying on the above tried and tested above legislative framework. It is the MFR that has changed over the years but contractors now have had several years to get used to the current version.

I believe a good look at the 2020/2021 QBCC Annual report gives a good indication as to the regulatory priorities the QBCC will adopt concerning the MFR.

Of the three key SOP regulatory initiatives I have addressed in this article, in my view, by far the surest regulatory approach the QBCC will adopt in 2022 is to do with the MFR. I cannot see the QBCC diverging much from their 2020/2021 strategies and priorities.

Famous last words !!

Final thoughts.

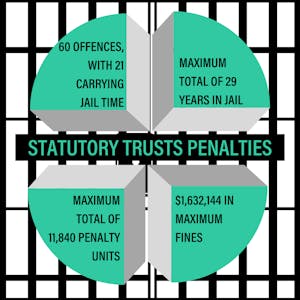

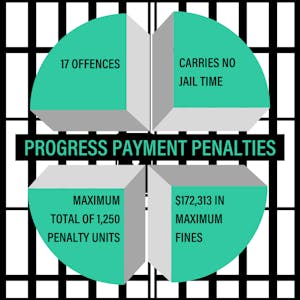

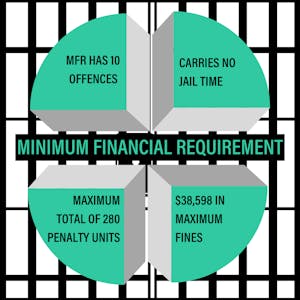

Contractors need to get their business in SOP order or suffer the consequences. Let’s look at the number of offences with various penalties under each of these three initiatives.

Statutory Trusts.

Progress payments.

MFR.

In summary, there are 87 offences with penalties that contractors must be aware of concerning these three SOP initiatives.

Helix Legal Event: Trusts are a reality, are you ready?

If you want to learn more about the implementation of Statutory Trusts, click the picture below and secure yourself a spot at our Event on December 1 2021. We hope to see you there!

Not intended as legal advice. Read full disclaimer.