‘Sales are vanity, profit is sanity but cash is king’ in the construction industry.

The heading for this article incorporates a quote from the CEO of Volvo Cars back in 1980. A different era perhaps but this phrase has become a mantra for business managers all over the world and has never been so relevant than for those who manage construction companies in Queensland right now as we move into a new era of regulation for our industry.

Construction businesses across the world are renowned for being ‘cash hungry’ and the Australian industry is no different.

A particular feature of the construction industry is that of security and, particularly, how cash retentions are used as a vital part of the security toolkit.

Outside the industry, there’s a perception that many Head Contractors are cash rich. This may be partly due to the fact that they hold subcontractor cash retentions (i.e. monies deducted from progress payments to subcontractors) and that this forms part of their day to day working capital.

Of course, it should be said at this point that the cash retentions withheld by Principals / Developers from progress payments to Head Contractors has the opposite effect on Head Contractors, draining or putting pressure on working capital.

Essentially, therefore, over time subcontractor cash retentions have become embedded into construction contracts and, specifically, Head Contractors’ business cash flows. This has all changed now.

While many people had concerns about Head Contractors being able to use subcontractor cash retentions as part of their day to day working capital, the enactment of the Building Industry Fairness (Security of Payment) Act 2017 (BIF Act) now means that this cash must be separated out of Head Contractors’ liquidity and held separately in Retention Trust Accounts (RTA).

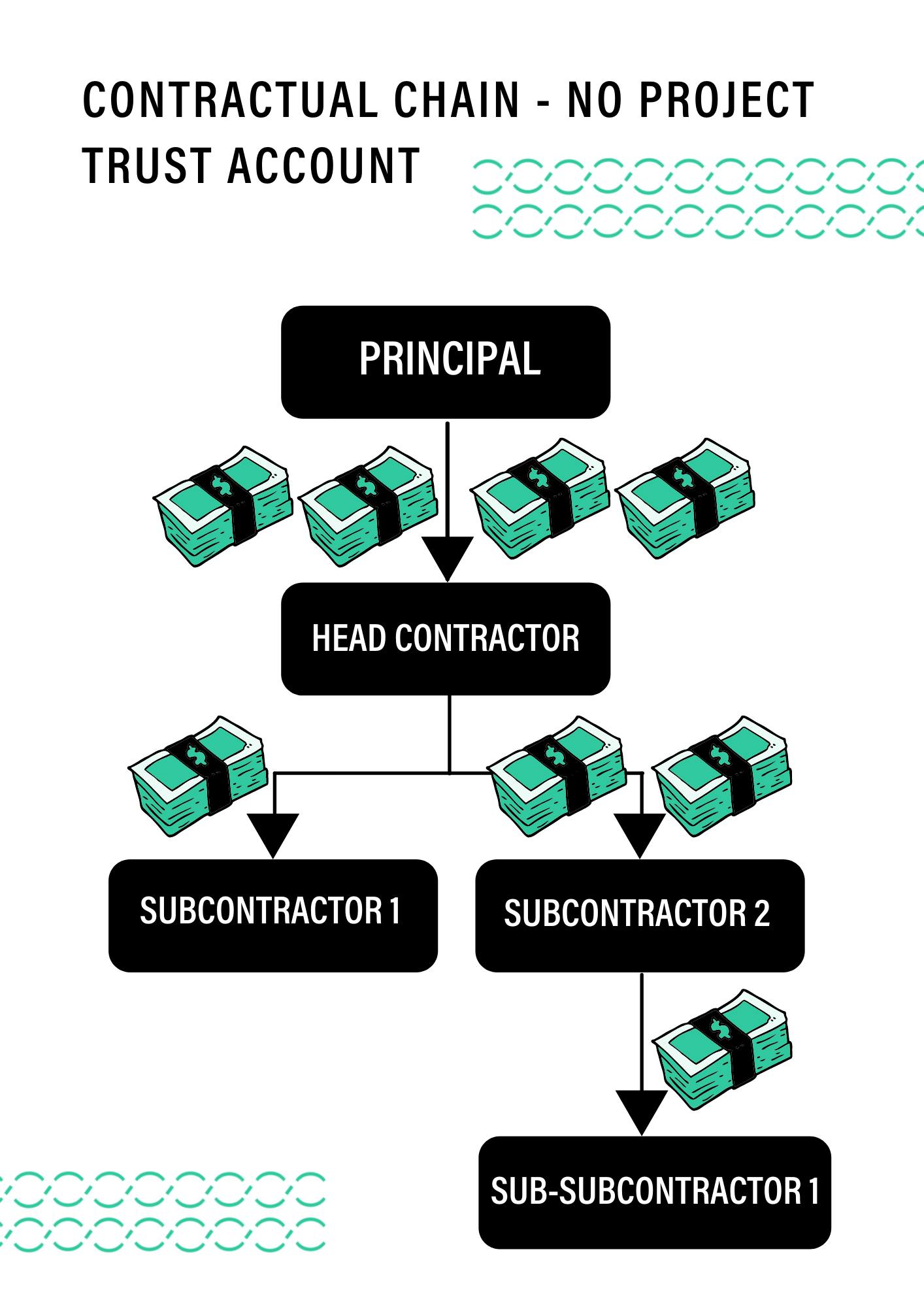

Under the BIF Act, that is designed to protect payments for subcontractors working on building and construction projects in Queensland, two types of trust account may be required if certain contract and other conditions are met:

- one Project Trust Account (PTA) per eligible project; and

- one RTA (if applicable) to hold cash retentions across multiple projects and subcontracts.

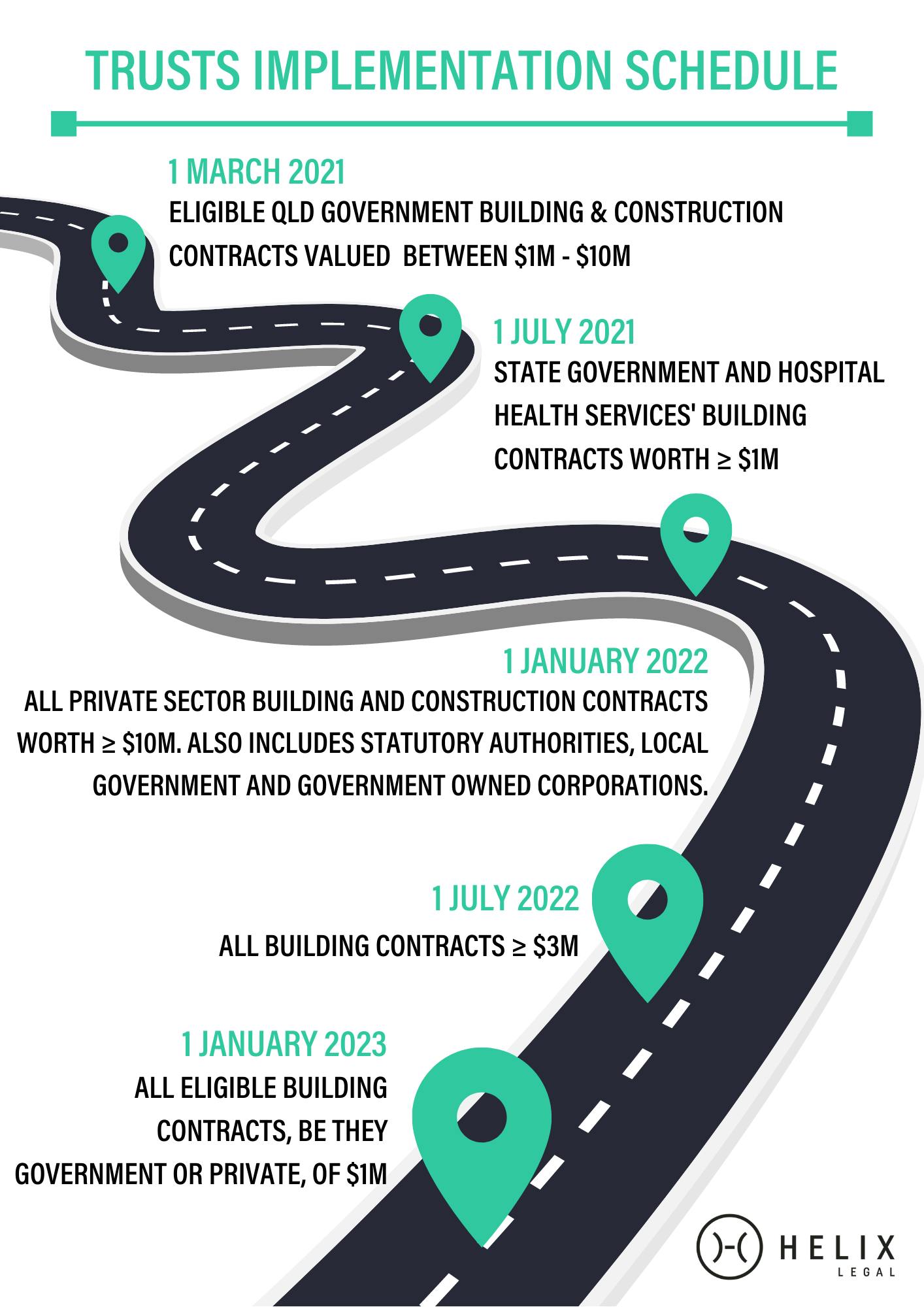

The Retention Trust reforms mean that Head Contractors will, on a staged basis over the next 15 to 18 months be unable to use cash retentions in their business cash flow.

Are Head Contractors ready for this significant change?

Construction industry financial managers are some of the most tenacious I have worked with across 35 years in engineering and construction, but I have a real concern that a sizeable proportion of Head Contractors may not yet have grasped the impact of having to remove subcontractors’ cash retentions from their day to day working capital over the next two years.

As the former CFO of one of Queensland’s largest private Head Contractor Building firms and now a member of the Helix Compliance team, I decided to model the likely effects that the impact of extracting subcontractors’ cash retentions from builders’ working capital balances will have.

I’m concerned that over the next 15 to 18 months builders, particularly those in the QBCC licence categories 2 to 5, will be under growing pressure as they work hard to compensate for the loss of the cash retentions from their day to day cash flows.

Head Contractors will need to find new sources of working capital if they are to bridge the gap as cash retentions leak out of their day to day funds. This could take time particularly when financial institutions and credit providers are getting to grips with the broader implications of the BIF Act changes.

At Helix, we have looked at these issues very carefully and are ready to speak to any Head Contractors who have concerns but haven’t been able to determine how their businesses will be affected.

Are you a QBCC licensee that will have to establish trusts?

We’ve developed a quick and easy to use tool to let you know if and when your business will be affected by the new Trusts regime, give it a try and it will point you in the right direction. Don’t hesitate to give us a call.