I have written approximately 130 Helix Legal articles where I have focused on conveying information to readers concisely, factually and always looking to be positive.

I do not like ‘shock and awe’ articles where the clear intent is to scare people into doing something. There are much better ways to engage with people.

However, on the other hand, I have never shied away from raising awareness on significant industry issues that are confronting, and indeed very uncomfortable to talk about.

Construction industry insolvencies are such an issue.

In my six years as the Compliance Manager of the industry regulator, I worked closely with many insolvency professionals and grew to hold a deep appreciation of the very real challenges parties in the construction industry encountered daily to remain financially viable.

As the person responsible for the suspension or cancellation of contractors’ licences for not meeting the financial requirements, I witnessed the devastating impacts of insolvency up close and personal.

I want to contribute towards finding meaningful solutions to this problem that has plagued the industry for decades.

With my Helix colleagues, I also have the benefit of aligning with like-minded people interested in the advancement of a better-informed industry, with some of them credited in this article for their assistance.

Queensland construction industry insolvency for 2020/2021 F/Y.

Based on the statistics, we all should be rejoicing the fact that there have been record-low industry insolvencies in the Queensland industry for 2020/2021 F/Y.

Regrettably, there is a reason for this as I will outline later in this article.

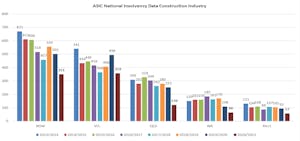

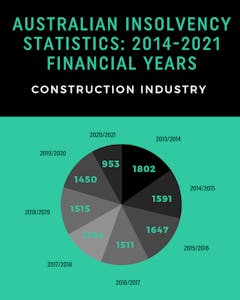

While the official ASIC insolvency figures for 2020/2021 F/Y have not been released, Wayne Clark, Executive Director of the Building Industry Credit Bureau (BICB), has very kindly provided me with the Bureau’s figures.

Source: BCIB August 2021

Concerning Queensland, these statistics show that for the 2020/2021 F/Y there were 120 insolvencies.

This represents a 57% reduction in Queensland construction industry insolvencies from the previous full pre-Covid-19 year (2018/2019 F/Y, 280 insolvencies).

Source: BCIB August 2021

The main takeaway from these statistics.

Queensland insolvencies represented 13% of all Australian construction industry insolvencies for 2020/2021 F/Y (120 of 953).

Every Australian jurisdiction had record low construction industry insolvencies for the 2020/2021 F/Y.

For this article, I do not intend to explore in detail the reasons for this being the case, other than to suggest that it is the result of:

- the ATO moratorium on issuing statutory demands and their “deliberate reduced active, outbound contact to recover outstanding amounts” (see below), and

- the government stimulus measures.

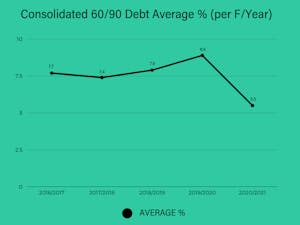

Regarding the positive impact of government stimulus, Wayne Clark has provided me with some very noteworthy data in terms of the reduction in debt above 60 days of their members.

It is significant to note that the BICB provides to approximately 220 members, comprehensive credit information about 175,000 plus entities that receive the supply of goods & services on credit in the building and construction industry in Australia.

This debt reduction is good news but I do make the obvious comment that at some point in time these stimulus monies will eventually cease ‘washing’ through the economy.

Source: BCIB August 2021

ATO recoveries.

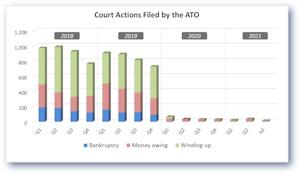

I want to thank Patrick Schweizer, Director of Alares Systems Pty Ltd, for the following information.

Source: Alares August 2021

While these court actions reflect all ATO recovery actions across all industries, for example, not just relating to the construction industry, it is apparent that the ATO has for now almost entirely ceased pursuing outstanding taxation liabilities through the courts.

In a report dated June 2021 by the Inspector-General of Taxation entitled An investigation and exploration of undisputed tax debts in Australia, it is stated:

“In FY16, the amount of collectable debt was $19.2 billion, and it increased to $34.1 billion in FY20 (an increase of 77.6%). The circumstances in FY20 are however unique and include the impacts of the Australian (2019) bushfires and COVID-19 pandemic. These impacts resulted in the ATO redeploying its officers to assist with COVID-19 recovery work which resulted in reduced active, outbound contact to recover outstanding amounts. The ATO also granted more than 12.9 million lodgement and payment deferrals in FY20. Deferred payments do not form a part of the reported collectable debt as the due date for payment was varied. Where the payment is made by the varied due date, it would not become a debt.”

I have been unable to identify similar ATO information for 2020/2021 F/Y. However, I am of the view that the above quote confirms the ATO’s “deliberate reduced active, outbound contact to recover outstanding amounts” and the information provided to me by Alares seemingly confirms that this policy position was maintained in 2020/2021 F/Y.

Final thoughts.

An increase in construction industry insolvencies will occur when the ATO commences enforcing debts.

While I don’t want to be a party pooper, I will also not be backward in telling it like it is because the industry needs to be ‘eyes up’ when it comes to understanding the potential insolvency risks of parties they may be considering working with.

Now more than ever, choosing the right businesses to work with is crucial to the success of each project.

Those who get these contracting decisions right will thrive, while those who get it wrong will struggle.

Not intended as legal advice. Read full disclaimer.