The title for this article is a tweak of the quote “you don’t know what you don’t know”.

Reflecting on meetings and conversations my Helix colleagues and I have had with parties that are going to be impacted by the implementation of trusts, the one thing that stands out is the extent to which these parties are unaware of how they will be affected.

It does not matter whether the party is from the big end of town, a medium-sized subcontractor, or everybody in between. Sure, the risks and obligations for these parties will be very different, but they nonetheless represent a significant regulatory disruption to their business.

How has this happened?

The implementation of trusts has been flagged since August 2017.

However, it appears that many parties have refused to believe that such a major regulatory regime would ever be implemented.

In my view, the industry Regulator, the QBCC has done a good job in developing useful information. However, as I found in the 22 years I worked for the Regulator and where I was heavily involved in developing and delivering educational initiatives for contractors, there is a significant amount of scepticism towards anything of an educational nature presented by the Regulator.

The quote from the former President of the USA, Ronald Reagan comes to mind when I reflect on the reasons for this scepticism:

“The most terrifying words in the English language are: I’m from the government and I’m here to help”

This scepticism is also hardly surprising given that the Regulator has to bridge educational responsibilities, industry compliance and enforcement obligations. Helping contractors one day, and potentially cancelling their licence the next day. This presents a real challenge for the Regulator to effectively deliver ‘trusted’ information.

Having said all that, how can this lack of awareness on the implementation of trusts be addressed?

Shock and awe initiatives?

Helix will never adopt such a strategy.

Instead, Helix will do what we have now done for years concerning increasing the awareness of trusts. We will continue to develop and present easily understood information in bite-size chunks for parties to digest.

How has this situation arisen?

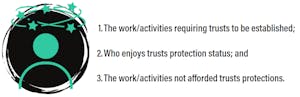

In my opinion, parties are very confused about:

The provisions relating to the establishment of statutory trusts are contained in chapter 2 of the Building Industry Fairness (Security of Payment) Act 2017.

There are two types of trust accounts that may be required if certain conditions are met, namely:

- One project trust account (PTA) per eligible project; and

- One retention trust account (RTA) (if applicable) to hold cash retentions across multiple projects and subcontracts.

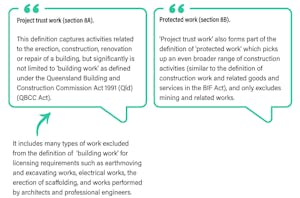

There are two new important definitions of work, namely:

What is the significance of ‘protected work’?

‘Protected work’ is important to decide when a subcontractor will become a beneficiary of a project trust. Where a project trust is needed for a head contract, a subcontractor to that head contract will be a beneficiary if its subcontract is for ‘protected work’ and the subcontract price is at least the minimum contract price.

In effect, this means that a subcontractor can be a beneficiary even if its works are not ‘project trust work’.

Let’s be honest, all this is very confusing and hard to understand.

As a non-lawyer, I have spent many years reading construction legislation and trying to understand it. I have to say that the BIF Act as it relates to the establishment of trusts is extremely challenging in this regard!

It significantly comprises provisions to capture particular work and activities, in the process relying on two new key definitions of work and other provisions to exclude particular work and activities in certain circumstances.

This makes messaging very difficult.

Furthermore, some parties may be covered in a certain situation but not in another situation. For example, a subcontractor carpenter working for a head contractor on a small scale residential project will not enjoy the protection of getting paid through a PTA.

However, that same subcontractor working for the same head contractor on a large residential unit project will get paid on this job through a PTA.

Consequently, many trusts myths have developed.

I will seek to address 10 trusts myths in this article and a further 10 in a subsequent article.

While it is the responsibility of a head contractor, as the contracted party for ‘eligible contracts’ for ‘project trust work’ to establish a PTA and be trustee, the principal, owner or developer as the contracting party must pay any monies payable to the head contractor into the PTA rather than directly to the head contractor.

See section 19 of BIF Act. A principal, owner or developer commits an offence if they fail to comply with this requirement unless certain circumstances apply.

From 1 January 2022, a principal, owner or developer (contracting party), engaging a head contractor (contracted party) required to establish a project trust, must establish an RTA for depositing cash retentions they are withholding from the head contractor.

See part 3, chapter 2 of the BIF Act.

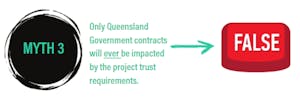

It is true, at the time of writing this article (September 2021) only government contracts, valued at $1 million or more, are captured and that will remain the case for the remainder of 2021.

However, by 1 January 2023, over a staged implementation process during 2022, all government, private sector, local government, statutory authorities and government-owned corporations contracts valued at $1 million or more will be captured.

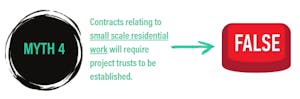

Section 15C of the Building Industry (Security of Payment) Act 2017 (BIF Act) specifies that a project trust is not required for a contract if the only work to be carried out under the contract is small scale residential construction work for less than 3 living units.

Contracts primarily for civil work (i.e. less than 50% project trust work) do not require the establishment of project trusts.

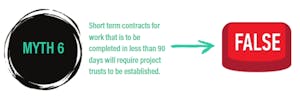

Project trusts are not required for contracts with less than 90 days until practical completion. See section 15F of BIF Act.

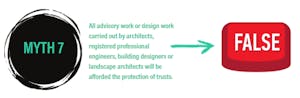

Contracts solely for advisory work or design work carried out by architects, registered professional engineers, building designers or landscape architects, or contract administration carried out by such persons for the construction of a building wholly or partly designed by them do not get the protection of trusts. See section 15E of BIF Act.

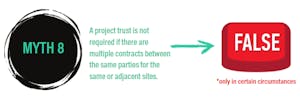

If the same parties entered into two or more separate contracts for project trust work at the same or adjacent sites, those separate contracts will be treated as a single contract to determine whether a project trust is required.

Warning. Think very carefully about splitting contracts as means of trying to avoid having to establish a project trust.

State government, statutory authority and local government principals are exempt from the requirement to hold cash retentions in a retention trust account.

As of the date of publishing this article, only five financial institutions are approved by the QBCC where trustees (head contractors, principals, owners or developers as the case may be) may open and operate both PTA and RTA, namely:

- Commonwealth Bank of Australia

- Macquarie Bank

- National Australia Bank

- HSBC

- Westpac

Are you a QBCC licensee that will have to establish trusts?

We’ve developed a quick and easy to use tool to let you know if and when your business will be affected by the new trusts regime, give it a try!