In an article I published in September 2019 entitled Building Businesses: Let’s talk about how the QBCC is regulating the building industry, I outlined how in a ‘pre-COVID-19’ environment, the QBCC intended on regulating the construction industry. I pointed out:

“For some time now, the QBCC has been signalling its intention to regulate the industry on a greatly expanded basis, and in the process focus on the activities and behaviours of parties that cause the greatest risk to other industry participants and consumers. In the 2017/2018 QBCC Annual Report, it is stated:

“Traditionally, we regulated building and trade contractors, certifiers, plumbers, pool safety inspectors, fire protection, air-conditioning and mechanical services tradespeople by requiring that they hold a QBCC licence and comply with the appropriate legislation. However, over the past 12 months the building and construction sector regulatory ecosystem has grown, specifically through the enhanced safety powers to include manufacturers, importers and designers.”

In the QBCC 2018/2019 Compliance and Enforcement Strategy, it is stated:

“Resulting legislative amendments have significantly expanded the QBCC’s regulatory function including new laws around non-conforming building products and financial matters. The changes have seen the QBCC become responsible for regulating not only the people who use building products that do not comply with the National Construction Code, but also the people who form part of the supply chain for those products (the “chain of responsibility”), including domestic manufacturers and importers of those products. Similarly, new laws around financial security, including requirements to establish Project Bank Accounts, have altered the QBCC’s regulatory functions and stakeholder expectations.”’

Present time

As at the date of publishing this article, the above mentioned compliance and enforcement strategy is shown as current on the QBCC website.

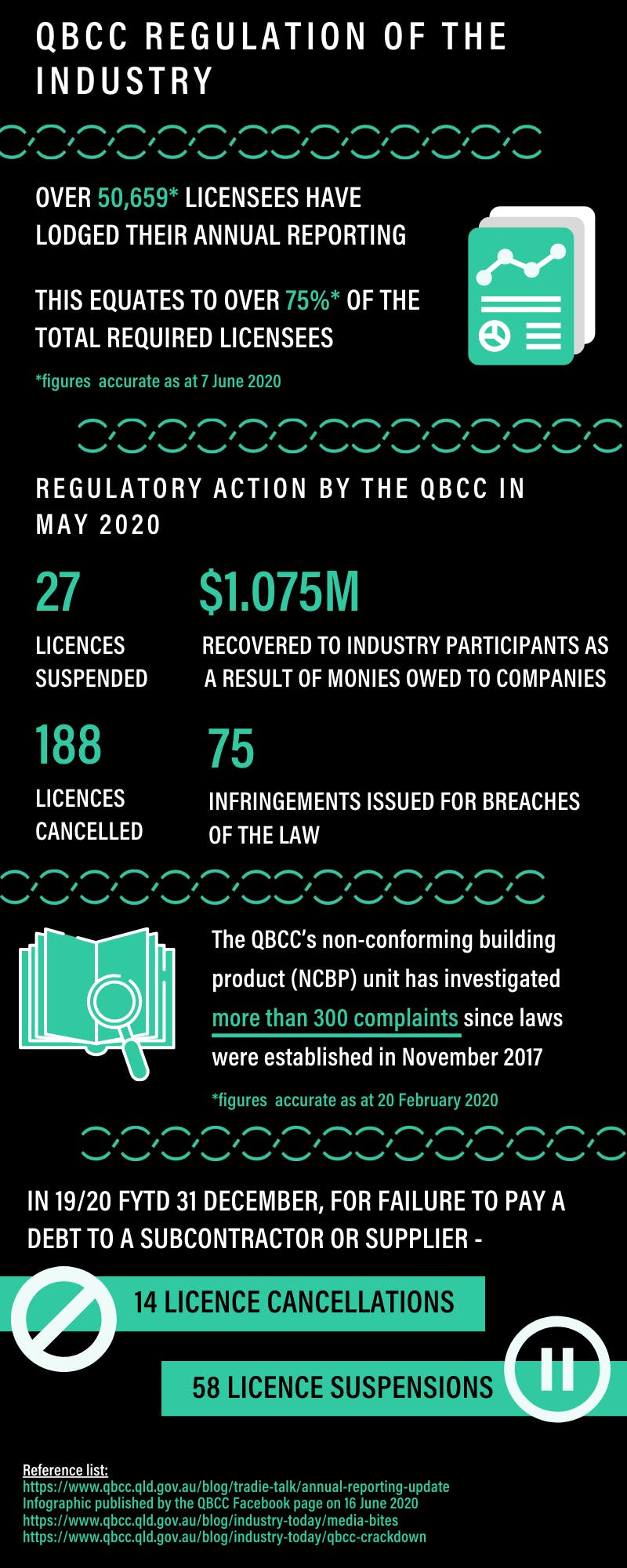

In terms of other QBCC public record material, below is an infographic which reflects compliance and enforcement information gathered from four separate QBCC sources.

Temporary changes to regulatory approach under consideration

In a recent article entitled Good news. Regulation of the construction industry may be modified to recognise COVID-19 crisis, I stated:

“On 7 April 2020, a member of the Council, the QBCC, sought feedback from stakeholders about its regulatory approach during this crisis.

In the published minutes of this meeting, I have noted a conciliatory and pragmatic tone by representatives of the QBCC that I found very encouraging, namely:

-

- The regulatory approach must have regard to the current environment and will focus on the greatest risks.

- Some temporary changes may be appropriate to the regulatory approach.

- Consideration may be given for non-financial penalties concerning certain less serious offences.

- Concerning the payment of debts under the Minimum Financial Requirements, if it can be established that a licensee has commenced paying the debt, compliance action may be placed in abeyance in those instances.

- If a certifier cannot perform their obligations due to this crisis, the QBCC would not look to impose a penalty”

Hear directly from the QBCC

Special Announcement: Kate Raymond, Assistant Commissioner of the QBCC, will be joining the Helix Legal Team on 24 June 2020 to discuss the here and now of the regulation of the construction industry in Queensland.

The Minimum Financial Requirements for licensing caught several companies off guard in 2019. Learn from mistakes with insight from the team at Helix Legal as part of their Building Better Business Series.

Under the Minimum Financial Requirements for Licensing, since 1 January 2019 the QBCC has progressed through 2 phases of assessment:

- Phase 1 – ‘signed financial statements’ from 742 large contractors; and

- Phase 2 – declarations from self-certifying licensees who have a turnover not exceeding $800,000 and licensees who have a turnover greater than $800,000 but less than $30 million.

There were approximately 70,000 licensees that are captured by these two phases.

What are the lessons learnt from those who got caught out in the changes?

Register for Helix Legal’s event this Wednesday, 24 June at 10:30am, by clicking here.