You would be excused in thinking that the New South Wales and Queensland Governments are locked in a State of Origin battle of vastly different strategies in relation to giving effect to the key SOP initiatives, namely:

- progress payments; and

- adjudication.

Once all the New South Wales and Queensland strategies are implemented in relation to these initiatives, the differences will prove to be extremely challenging for contractors operating in both jurisdictions.

In the case of Queensland, these initiatives have been developed and implemented through the Building Industry Fairness (Security of Payment) Act 2017 (BIFA).

New South Wales, on the other hand, has developed new strategies but not yet implemented them through the Building and Construction Industry Security of Payment Amendment Act 2018 (BCISPAA).

BCISPAA was assented (signed by the governor into law) on 28 November 2018, but none of the provisions have yet been proclaimed to commence. The New South Wales government issued a paper in December 2018 where they canvassed staged BCISPAA implementation options.

Consequently, at the time of publishing this article the current strategies in relation to these key New South Wales SOP initiatives are contained in the Building and Construction Industry Security of Payment Act 1999 (BCISPA).

A strange time for these governments to ‘do their own thing’

The divergence in strategies being adopted by these two States to resolve payment problems in the industry is very surprising given that there is currently a strong push for all States and Territories to harmonise their SOP legislation with the publishing of a report in December 2017 by John Murray AM, entitled ‘Review of Security of Payment Laws‘.

On the Commonwealth government Department of Jobs and Small Business website it is stated:

“the Australian Government is working with the States and Territories through the Building Ministers’ Forum (BMF) to consider and respond to the findings and recommendations of the Review.

The BMF comprises the group of Australian Government, State and Territory Ministers with responsibility for building and construction. The BMF is responsible for overseeing governance of the built environment, in relation to policy and regulatory issues impacting the building and construction industries.”

The BMF most recently met on 8 February 2019, issuing a communique where it was stated:

“Ministers also discussed the National Review of Security of Payment Laws, and agreed the Senior Officers’ Group will develop model legislation for deemed statutory trusts, for jurisdictions to draw upon.”

Queensland v New South Wales – SOP strategies

As a result of New South Wales developing strategies that are lawful, but not yet implemented, I have decided to summarise the relevant significant:

- current Queensland strategies;

- current New South Wales strategies; and

- future New South Wales strategies.

Progress payments – Queensland strategies

In relation to progress payments, the main Queensland strategies under BIFA are:

- Payment claims do not need to state that they are made under section 68 of BIFA.

- A claim or invoice from a contractor, consultant or supplier is considered a payment claim under BIFA if it:

- identifies the construction work (or related goods and services);

- states the amount claimed; and

- requests the claimed amount be paid.

- There can only be one valid payment claim for each ‘reference date’ and the payment claim may be provided on or after the applicable ‘reference date’.

- Unless the payment claim relates to a final payment, the claim must be given before the end of whichever of the following periods is the longest:

- the period, if any, worked out under the construction contract;

- the period of 6 months after the construction work to which the claim relates was last carried out or the related goods and services to which the claim relates were last supplied.

- Section 67(2) of BIFA provides a statutory reference date for terminated contracts where none is provided. The reference date is the day the contract is terminated.

- When a person receives a payment claim (respondent), they must either:

- pay the full amount claimed by the due date – if they agree with the amount claimed; or

- give the claimant a payment schedule (section 76(1) of BIFA) within 15 business days from receiving the payment claim or earlier if provided for in the contract and ensure the scheduled amount is paid by the due date – if they don’t agree with the amount claimed.

- Failing to issue a payment schedule within the time frame (and then also not paying the claimed amount in full by the due date) is an offence and a maximum of 100 penalty units may apply.

- Respondents get only one opportunity to provide a payment schedule.

- Additionally, if the respondent fails to issue a payment schedule, they:

- become liable for and must pay the full amount of the payment claim by the due date; and

- cannot provide a response if the claimant proceeds to adjudication for the payment claim.

- Based on a New South Wales Court of Appeal decision Seymour Whyte Constructions Pty Ltd v Ostwald Bros Pty Ltd (in liquidation) [2019] NSWCA 11, it would appear that BIFA is capable of applying for the benefit of contractors that are in liquidation in the same manner because the relevant current NSW legislation, like BIFA, does not specifically exclude such an entitlement.

- The maximum payment period for payments from a head contractor to a subcontractor is 25 business days.

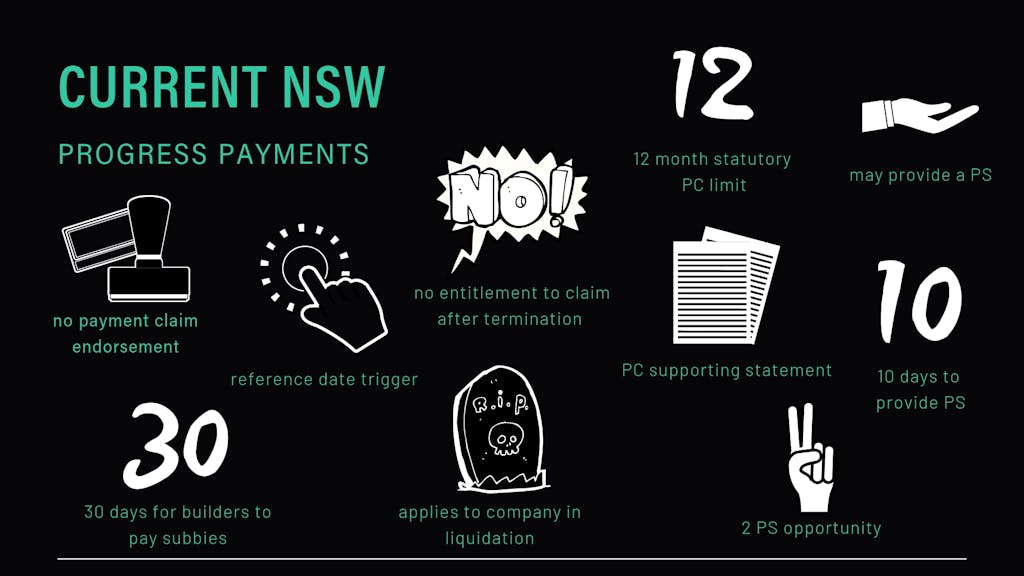

Progress payments – current New South Wales strategies

- Under section 13 of the Building and Construction Industry Security of Payment Act 1999 (BCISPA), there is no requirement for payment claims to be stated that they are made under the Act, with one exception. If a subcontractor has a contract in connection with a residential construction contract, they must endorse a payment claim as being made under BCISPA.

- A payment claim endorsed under BCISPAA must:

- identify the construction work (or related goods and services);

- state the amount claimed;

- if made by a head contractor on a principal, be accompanied by a supporting statement (all subcontractors have been paid) that indicates that it relates to that claim;

- there can only be one valid payment claim for each ‘reference date‘ and the payment claim may be provided on or after the applicable ‘reference date’; and

- be served only within:

- the period determined by or in accordance with the terms of the construction contract; or

- the period 12 months after the construction work to which the claim relates was last carried out (or the related goods and services to which the claim relates were last supplied).

- When a person receives a payment claim (respondent), they are not required to respond by providing a payment schedule but under section 15 of BCISPA if they adopt such a position, they must pay the full amount claimed by the due date.

- Alternatively a respondent may give the claimant a payment schedule under section 14 of BCISPA disputing the amount claimed. So long as a respondent provides reasons for adopting this position and pays the scheduled amount by the due date, they have satisfied the legislative requirements. However in such circumstances a claimant may elect to proceed to adjudication.

- If a respondent fails to provide a payment schedule and pay the full amount claimed by the due date for payment, a claimant cannot proceed to adjudication unless they give the respondent notice of intention to make an adjudication application within 20 business days of the due date for payment. In these circumstances, the respondent is afforded another opportunity to provide a payment schedule.

- If a respondent fails to provide a payment schedule, they cannot lodge an adjudication response.

- Based on a New South Wales Court of Appeal decision Seymour Whyte Constructions Pty Ltd V Ostwald Bros Pty Ltd (in liquidation) [2019] NSWCA 11 BCISPAA is capable of applying for the benefit of contractors that are in liquidation.

- The maximum payment period for payments from a head contractor to a subcontractor is 30 business days.

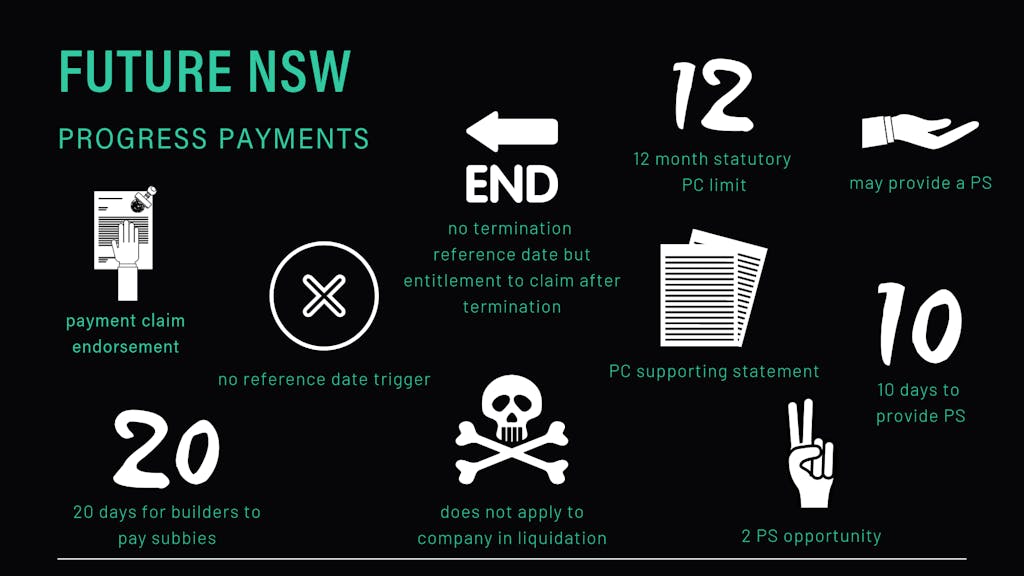

Progress payments – future New South Wales strategies

Under clause 11 of BCISPAA, payment claims will all need to state that they are made under the BCISPA.

- A payment claim endorsed under BCISPA must also address all the other above current requirements.

- The ‘reference date’ requirement has been done away with. Under clause 10 of BCISPAA, a payment claim may:

- be served on and from the last day of the month in which the construction work was first carried out (or the related goods and services were first supplied) under the contract and on and from the last day of each subsequent named month. However, if the construction contract concerned makes provision for an earlier date for the serving of a payment claim in any particular month, the claim may be served on and from that date instead of on and from the last day of that month; and

- other than the above change, be served in accordance with current requirements.

- Clause 10(1C) of BCISPAA provides that a payment claim may be served on or from the date the contract is terminated.

- Under clause 32B of BCISPAA, a company in liquidation cannot serve a payment claim on a person or take action to enforce a payment claim (including by making an application for adjudication of the claim) or an adjudication determination.

- The maximum payment period for payments from a head contractor to a subcontractor is 20 business days.

Adjudication – Queensland strategies

There are 3 ways in which a claimant can proceed to adjudication after serving a payment claim on a respondent, namely they:

- receive a payment schedule in response to a payment claim but do not agree with it and lodge an adjudication application within 30 business days of receiving the payment schedule;

- receive a payment schedule in response to a payment claim but do not receive the full amount stated in the payment schedule by the due date and lodge an adjudication application within 20 business days after the due date for payment; or

- do not receive a payment schedule in response to a payment claim or full payment by the due date and lodge an adjudication application within 30 business days after the due date for payment or the last day for responding with a payment schedule (whichever is later).

- The Adjudication Registry within the QBCC receives all adjudication applications and appoint adjudicators.

- In respect of adjudication applications where the payment claim is $25,000 and under, the claimant’s submissions must be no more than 10 pages and if typed be size 10 font or bigger with a margin of 2.54cm.

- The same restrictions apply in respect of respondents providing adjudication responses to adjudication applications where the payment claim is $25,000 and under.

- With regard to adjudication responses to a standard claim (up to $750,000), it must be submitted within 10 business days of receiving a copy of the adjudication application, or within 7 business days of receiving notice that the adjudicator accepts the application.

- For complex claims (more than $750,000), the response must be submitted within 15 business days of receiving a copy of the adjudication application, or within 12 business days of receiving notice that the adjudicator accepts the application. Respondents may also apply to the adjudicator for a time extension of up to 15 business days if they need more time to respond.

- For standard claims (up to $750,000), the adjudicator must make a decision within 10 business days of the response date.

- For complex claims (greater than $750,000), the decision must be made within 15 business days of the response date.

- The response date is the day the adjudicator received the adjudication response from the respondent or the last day that the adjudication response could have been given. An adjudicator may request an extension of time to decide the application.

- The Queensland Government has confirmed the role of the Adjudication Registry within the QBCC for receiving adjudication applications and appointing adjudicators. I addressed this issue in detail in an article entitled Is Adjudication Shopping about to make a comeback in Qld?.

- The QBCC has excellent information concerning the requirements of adjudicators under BIFA.

Adjudication – current New South Wales strategies

There are 3 ways in which a claimant can proceed to adjudication after serving a payment claim on a respondent, namely they:

- receive a payment schedule in response to a payment claim but do not agree with it and lodge an adjudication application within 10 business days of receiving the payment schedule.

- receive a payment schedule in response to a payment claim but do not receive the full amount stated in the payment schedule by the due date and lodge an adjudication application within 20 business days after the due date for payment; or

- do not receive a payment schedule in response to a payment claim or full payment by the due date. In these circumstances the claimant must:

- notify the respondent within 20 business days of the payment due date of their intention to apply for adjudication;

- afford the respondent 5 business days to provide a payment schedule after they receive the notice of intention; and

- lodge an adjudication application within 10 business days of the 5 day payment schedule period.

- A claimant can lodge an adjudication application with an Authorised Nominating Authority (ANA), who is an organisation authorised by the Minister under section 28 of BCISPA to nominate persons to determine adjudication applications.

- After having lodged an adjudication application, under section 26A of BCISPA a claimant may ask a principal contractor to keep money to cover a claim that is or will be payable by the principal contractor to the respondent. The principal contractor is the person who engaged the respondent to do work, which the respondent then subcontracted to the claimant.

- A respondent can only respond to an adjudication application if they have provided a payment schedule to the claimant within the required time periods. See Department of Fair Trading website.

- The adjudicator has 10 business days to make a determination after notifying the claimant and respondent that an application has been accepted. However, a longer time may be given if agreed to by both parties.

- The New South Wales Government through the responsible Minister has appointed 7 ANAs to receive adjudication applications and appoint adjudicators.

- These ANAs are required to comply with a Code of Practice.

Adjudication – future New South Wales strategies

There are some miscellaneous reforms outlined in a SOP implementation options paper (page 6) that for the purpose of this article I do not consider to be of a significant nature.

Key differences

Progress payments

Adjudication

| Current QLD | Current NSW | Future NSW |

| if PS unsatisfactory, 30 days to lodge AA | if PS unsatisfactory, 10 days to lodge AA | if PS unsatisfactory, 10 days to lodge AA |

| no PS & not paid in full, 30 days to lodge AA | no PS & not paid in full, ‘2nd chance’ PS | no PS & not paid in full, ‘2nd chance’ PS |

| government Adjudication Registry | private ANAs | private ANAs |

| no principal contractor requirement | principal requirement | principal requirement |

| 10 days for Adj to decide ‘standard claims’ | 10 days for Adj to decide all claims | 10 days for Adj to decide all claims |

| 15 days for Adj to decide ‘complex claims’ | N/A | N/A |

Final thoughts

I have heard it said that the New South Wales and Queensland SOP laws are the same. I beg to differ. The differences are very stark and the gap is widening. Contractors operating in both States need to have tailored contract administration practices and procedures that address the different progress payment and adjudication requirements in New South Wales and Queensland.

Not intended as legal advice. Read full disclaimer.