Main Content

Intro

The purpose and effectiveness of the MFR is outlined in the Explanatory Notes for an SOP Bill introduced into parliament on 5 February 2020, where it is stated:

“The first phases of the MFR reforms led to a capital injection of $1.2 billion into the Queensland building and construction industry, resulting in a stronger, more confident industry. The changes help support financially healthy businesses that are capable of sustained growth, as well as providing greater certainty that subcontractors will be paid for the work they do.”

We expect that for categoryis the grouping of similar goods or services with common demand drivers and a similar supply base. 4 to 7 licensees, the QBCC will continue to require them to strictly comply with all aspects of the MFR. Furthermore, we think that it is highly likely that for these high turnover contractors, they will have to get their reports in on time. It’s our view that the QBCC will not entertain any delays of this nature unless the reasons are very compelling.

It is also our view that the QBCC will require these large contractors to strictly adhere to all aspects of the MFR. Such a strong position by the QBCC is demonstrated in reported dealings the QBCC has had with CPB contractors. In an article in the Australian Financial Review, it is stated:

“CIMICs construction subsidiary CPB contractors has been told by Queensland regulators to prove it has enough cash to keep building projects such as Brisbane’s $5.4 billion Cross River Rail after concerns were raised over its financial viability.

The Queensland Building and Construction Commission (QBC) is understood to have sent a letter to CPB contractors on Wednesday asking why its licence to operate shouldn’t be suspended after it refused to provide a Minimum Financial Requirement (MFR) report when its net tangible assets dropped below 20 per cent.

CPB contractors’ net tangible assets- its total assets excluding intangible assets such as goodwill, patents, and trademarks – dropped below the required threshold earlier this year after it gave its parent company CIMIC a $700 million loan.”

What mistakes and mishaps will the QBCC be looking for?

For all contractors, big or small, any failure on their part to meet their liabilities as and when they fall due, or satisfy a court judgment or an adjudication decision, will result in the QBCC reviewing their entitlement to remain licensed.

You should also expect the QBCC to be looking at:

- Market data and intelligence.

- Legal actions involving contractors.

- The news.

- The industry – contractors with problems are normally well known in the industry.

- Information provided in Annual Reporting.

- Debtor Reports – Keeping in mind debtors of over 1 year in age are excluded as assets, it would be easy to see the QBCC focusing their attention on older debtors. For example, if a 30 June 2019 debtor list provided by 31 December 2019 already included some debtors close to 180 days old, it would not be difficult for the QBCC to ask for an updated debtors report to prove it was collected.

- Audited accounts – These can be a rich source of disclosures as to debtor recoverability, disputes, concern and other information that may better inform a reader of what is going on.

- Profit and loss analysis – Significant legal fees could indicate jobs in dispute. This may then create a focus on which jobs those relate to and what debtors, retentions and WIP are in the accounts.

As the inaugural Compliance Manager for the predecessor of the QBCC, the BSA, Coach Michael Chesterman was responsible for managing several thousand investigations into financially troubled contractors. This position and his role at Helix Legal have allowed him to view firsthand the mistakes and mishaps of MFR compliance.

Mistakes and mishaps can occur at any stage of compliance with your reporting obligations. Contractors are required to report their financial information or continued compliance with the Queensland Building and Construction Commission (Minimum Financial Requirements) Regulation 2018 at the following times:

- on application for a licence;

- where the maximum revenue (MR) requires adjustment for categories 1-7, licensees within SC1 and SC2 will be required to provide the self-declaration form; as outlined on Financial reporting requirements for Self-certifying Category 1 and 2;

- where the MR requires adjustment;

- where the Net Tangible Asset position has decreased by more than:

- 30% for licensees within categories SC1, SC2 and categories 1-3

- 20% for licensees within categories 4-7.

- pursuant to an approved audit program;

- on expiry of the licensee’s Professional Indemnity Insurance Policy;

- on request by the licensee;

- change of ownership of directors, shareholders or other officeholders;

- restructure of partnership;

- change or withdrawal of Covenantors; or

- at the say so of the QBCC.

Lesson 3.1 Purpose

Insolvency is a major issue in the construction industry

The greatest mishap, setback or adversity that a contractor in the construction industry can experience is their business succumbing to some form of insolvency. In many instances, the full extent of the financial stress a contractor may be experiencing is only revealed when they sit down with their accountant or auditor and discuss the MFR.

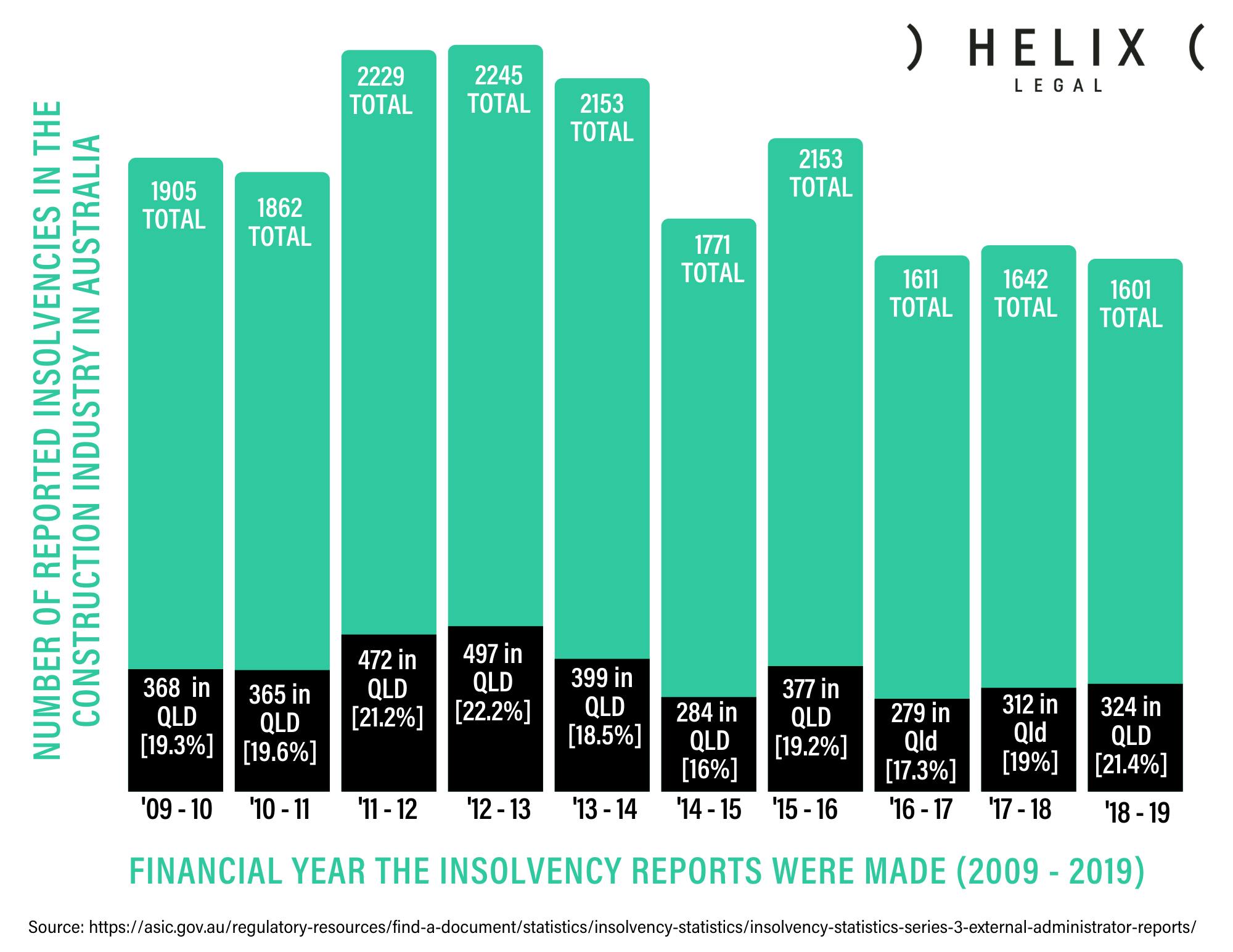

High rates of insolvency in the construction industry have been a major issue for decades.

In 2018, the Queensland Government established a panel to assess the implementation and effectiveness of SOP reforms. In its report, the panel indicated that there has been many government reviews and reports over the years.

View interactive version here.

One such report resulted from the Senate Economics References Committee Inquiry into Insolvency in the Australian Construction Industry (the SERC Inquiry Report) which found that:

- businesses operating in the construction industry are at a higher risk than any other single industry of either entering into insolvency themselves or becoming a victim of insolvency further up the contracting chain; and

- the construction industry’s rate of insolvencies is out of proportion to its share of national output. Over the past decade, the construction industry has accounted for 8–10% of Gross Domestic Product (GDP) but also accounted for 20–25% of all insolvencies in Australia.

The problem has a long history and an ever-evolving impact on the industry.

On 6 February 2019, Bill Hoffman of the Courier mail reported that “Queensland subcontractors owed $500 million across 50 building company collapses since 2013.”

The article explained that:

“More than 50 building companies have collapsed in Queensland since 2013 leaving more than 7000 subbies unpaid to the tune of $500 million, and more developers could collapse this year if urgent action isn’t taken to clean up the industry.”

Lesson 3.2 A cautionary word for interstate contractors and advisors

Interstate contractors and their advisors need to be very careful in making sure that they understand the MFR before deciding to work in Queensland. Finding out about MFR issues after commencing operations in Queensland may result in very significant restructuring costs.

Interstate contractors who have never previously worked in Queensland are usually shocked and surprised with the extent that the construction industry is regulated in this state. There are no equivalent comprehensive requirements in other states like the MFR.

Therefore, it follows that advisors who act on behalf of these interstate contractors must be well versed in the MFR and all their potential pitfalls such as:

- applying accounting standards on an audited set of accounts is not the be all and end all;

- a close review of the MFR regulations will bring the realisation that there are many nuances to the rules that need to be understood. For example, the treatment of goodwill and disallowed assets;

- related party loans have several hurdles to get through before they can be included as assets; and

- you can only include property as a current asset where it is listed on the market for sale.