In this article, I observe that insolvencies in the Queensland construction industry have remained at the same concerning level for years and I ask:

Will Statutory Trusts result in a reduction?

We will only know the answer to this question with certainty after the complete rollout is finished in 2023 but in the meantime, some steps can be taken today to control the risks associated with Trusts Compliance. In this article I consider:

- Historical View;

- Today’s Outlook; and

- Tomorrow’s concerns.

In a previous article dated 26 May 2021, entitled Trusts will jolt the construction industry to its foundation. Are you ready? I pointed out that Trusts are presently being rolled out on a staged basis. This roll-out has progressed over the last 5 months and we are now weeks away from a cold, hard reality for the private sector of the construction industry. At this point, the worst thing an impacted party can do is complain if they view these reforms in a negative light and hope by some miracle they disappear.

If you are in the “hoping for a miracle” boat, this is not going to happen!

So if Statutory Trusts are a reality – back to the question I posed – are they the cure the industry has been looking for?

The idea that Trusts may be a cure for the insolvency woes of the industry is not a concept invented by me. In introducing amendments to BIFA in February 2020, the responsible Minister stated:

“Australian tradies have experienced too much heartbreak, too often been left high and dry while developers and ruthless Head Contractors have walked away unscathed from company collapses. For those tradies who were on the road before most of us here even woke up this morning, it was not optional for them whether or not they went to work today. We are making sure everyone higher up the chain does not have the option not to pay them in full and on time.”

Insolvency has been an issue for the construction industry in Queensland for my entire career. During the 22 years I worked for the Queensland industry regulator, I instructed and took part in investigations, writing reports, developing and delivering education campaigns and implementing legislation designed to address cash flow issues experienced by construction parties. After all this time, what I can say with absolute certainty is that the new trusts regime will not eliminate insolvencies in the industry.

I believe insolvencies will not be eliminated because, for example, under BIFA a Head Contractor must pay subcontractors even if they have not been paid by the principal for work done. This will mean that if they have insufficient other monies or means to raise capital to meet these payment obligations, they may succumb to insolvency.

If there is a shortfall of funds from the principal and a sustained obligation to top up the Project Trust Account (PTA) to pay subcontractors, the math is not difficult and it adds up to a cash-poor Head Contractor, soon unable to pay its debts as and when they fall due. In other words insolvent.

Example:

In the video below, you can see why I have concerns that failed Head Contractors may still leave unpaid Subcontractors in their wake.

Historical view: Insolvency has always been a major industry issue

In a report from 2019 by a special task force appointed to investigate subcontractor non-payment in the Queensland building industry, it is stated:

“The industry is the third largest employer in Queensland, employing more than 230,000 Queenslanders and contributing approximately $46 billion to the state economy in 2017–18.

The industry has been impacted by several high-profile company collapses in recent years. These highlighted widespread issues of late and non-payment, with subcontractors being disproportionately affected.

The system of cascading payments in the industry means that subcontractors are usually reliant on the contractors above them for payment. According to Deloitte

“…there is… an incentive for contractors higher up the chain to delay payments to those lower down to supplement their own cash flow and working capital.”

The Queensland experience is not unique. The culture of non-payment in the industry has been well documented, with multiple reviews by individual states and territories and at a national level. The Senate Economics References Committee’s 2015 inquiry into insolvency in the industry (Senate Inquiry) found that security of payment in the industry is a problem in all jurisdictions. The Senate Inquiry noted that nationally

“…the industry is burdened every year by nearly $3 billion in unpaid debts, including subcontractor payments, employee entitlements and tax debts averaging around $630 million a year for the past three years.”

View interactive version here where you can download the relevant reports.

Today’s Outlook: ASIC insolvency statistics.

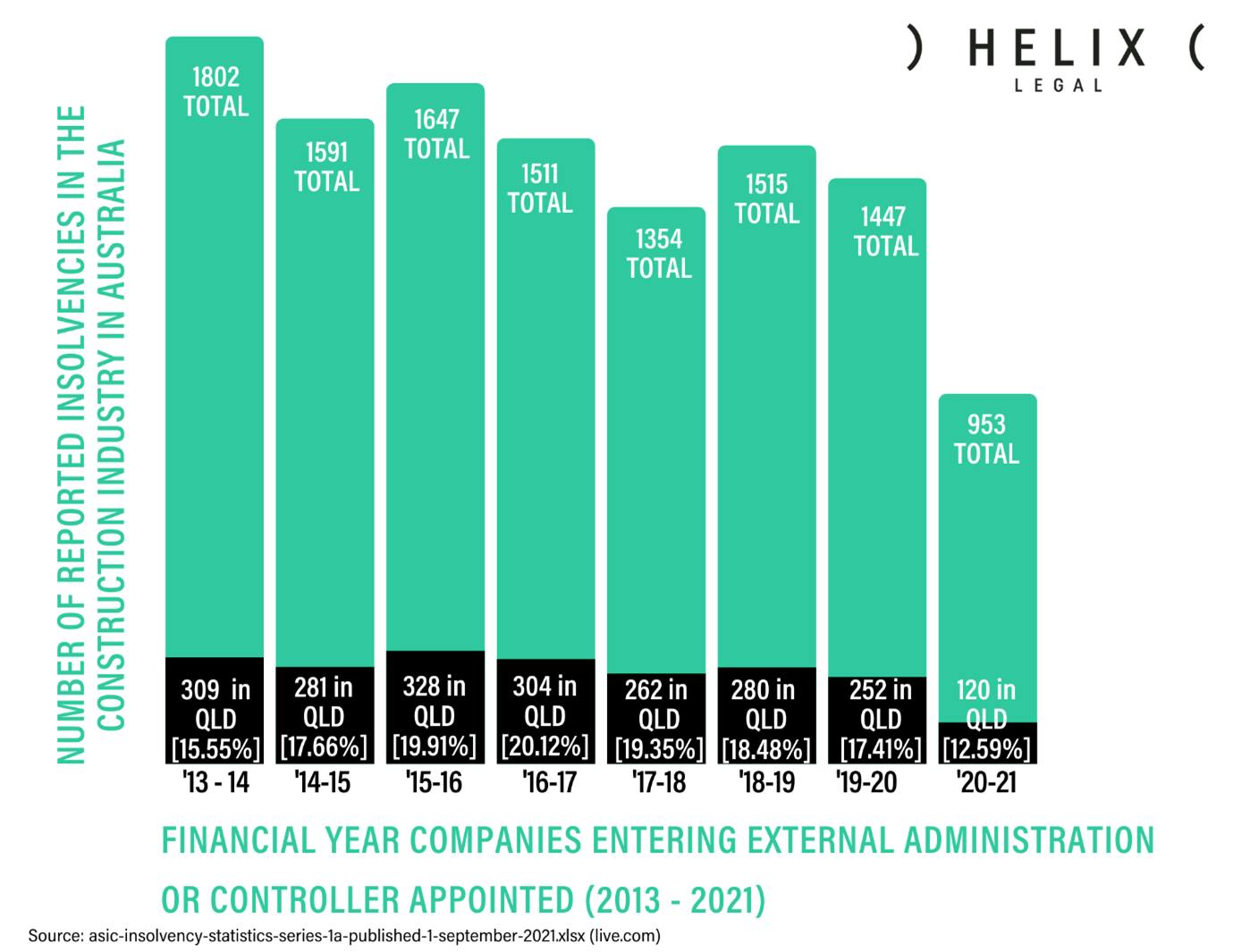

There is a record low of insolvencies in the construction industry in Australia – no question. See below ASIC insolvency statistics for companies entering external administration or controller appointed since 2013.

It should be noted that ASIC describes these statistics in the following manner:

“These statistics record the number of companies entering into a form of external administration for the first time each month by industry – from July 2013. The data is broken down according to industry. A company will be included only once in these statistics, regardless of whether it subsequently enters into another form of external administration. The only exception occurs where a company is taken out of external administration (e.g. as the result of a court order), and at a later date re-enters external administration.”

The significance of these statistics is that ASIC only commenced breaking down insolvency information by industry in 2013.

It should also be noted that these statistics do not include insolvent non-corporations e.g. small sole traders, who have entered into bankruptcy.

As I pointed out in a previous article entitled Good news = bad news in the construction industry, the Financial Year 2020/2021 concerning companies entering external administration or controller appointed was affected by several COVID-19 related issues.

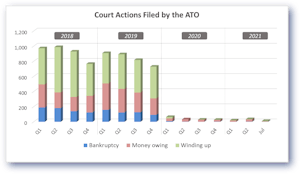

The main factor in the record low level of insolvencies in the industry for this financial year, I believe can be linked to the ATO commencing very few court actions to recover debts.

Tomorrow’s Concerns: ATO recoveries.

I want to thank Patrick Schweizer, Director of Alares Systems Pty Ltd, for the access to the following data.

Source: Alares August 2021

While these court actions reflect all ATO recovery actions across all industries, not just relating to the construction industry, it is apparent that the ATO almost entirely ceased pursuing outstanding taxation liabilities through the courts for the financial year 2020/2021.

I am therefore of the view that these ASIC statistics should not be considered representative of a ‘normal year’.

Final thoughts.

I am of the view, that based on seven years of ASIC data (financial years 2013/2014 – 2019/2020), the Queensland construction industry has seen no meaningful change concerning the level of insolvencies and while I live in a constant state of hope for the industry I love, I cannot conclude that the record lows of insolvency for the industry are due to BIFA and other related reforms that have been implemented to date.

If you want to know more about the Statutory Trusts roll out, please join me and my fellow speakers, Janelle Kerrisk and David Cahill on 1 December 2021 for our Building Better Businesses event: Trusts are a Reality, are you ready? Join us to hear from our Helix Compliance experts about the new trusts regime.

Are you a QBCC licensee that will have to establish Trusts?

We’ve developed a quick and easy to use tool to let you know if and when your business will be affected by the new Trusts regime, give it a try.