There is no bigger fan of adjudication than me. While not perfect, I nevertheless believe that adjudication has changed the construction industry for the better since its inception in 2004.

Adjudication has greatly assisted businesses who carry out construction work (claimants) to get paid. Before adjudication, businesses that received the benefit of such work (respondents) could rely on contractual provisions in their favour to deny or delay making payment. Subcontractors are the largest category of claimants (73%) and Head Contractors are the largest category of respondents (66%) (December 2018 published statistics).

In an article that I published on 25 February 2020 entitled Adjudication is ‘simply the best’, I outlined my reason for having this view.

How does adjudication work?

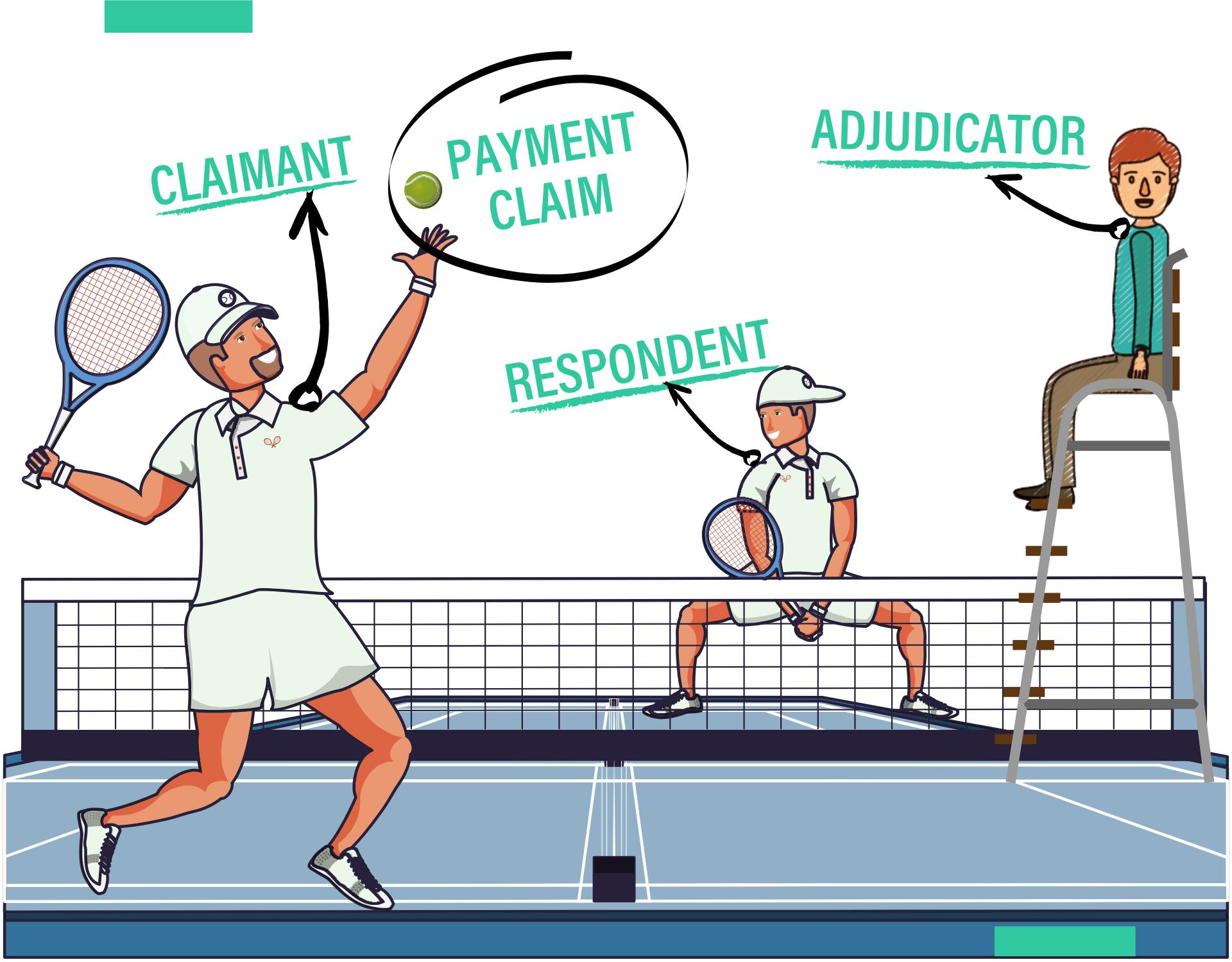

I like to explain adjudication in terms of a game of tennis between a subcontractor as a claimant and a head contractor as the respondent. I should make the point that this simple analogy reflects what most commonly happens in adjudication.

The subcontractor gets to serve a payment claim, setting out the amount claimed and a description of the works.

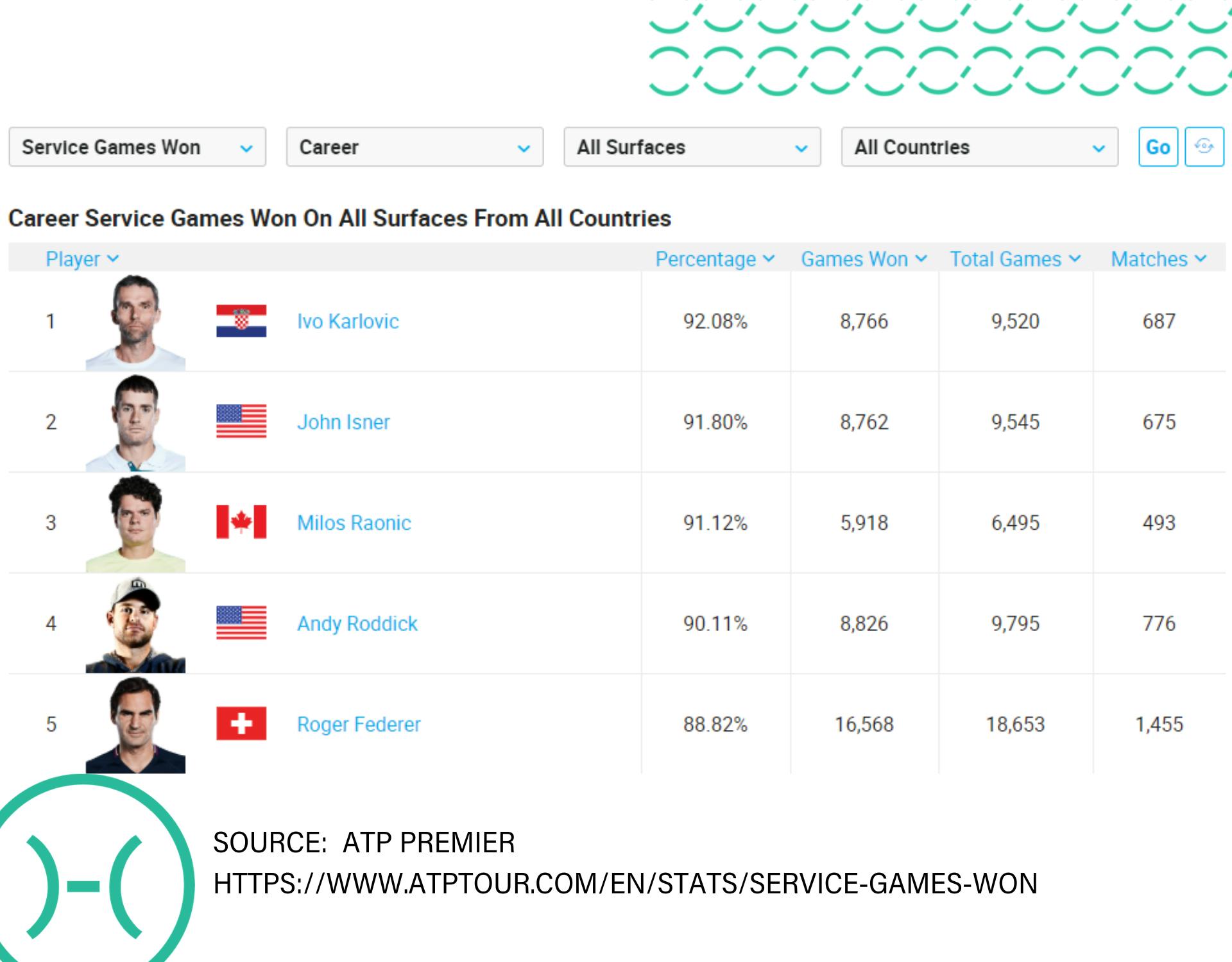

Only a claimant ever gets to serve a payment claim. This represents a huge advantage for claimants. Just to lighten things up a bit, I googled career service games won on all surfaces, from all countries, by top men players. Roger Federer has 88.82% as just one example.

The head contractor, subject to having a fair opportunity to sight the payment claim, must respond with a payment schedule outlining an amount it intends to pay (if any) and the reasons for no or partial payment, if it wishes to contest payment. The subcontractor may respond to a payment schedule with an adjudication application if it is unhappy with the proposed payment. The head contractor then may further respond with an adjudication response, expanding on the reasons for not paying as outlined in the payment schedule.

The adjudicator then has to decide based, most commonly only on their consideration of these four documents, if the subcontractor ought to be fully or partly paid, or not paid anything. It is not possible for the head contractor to obtain payment in its favour, even if the adjudicator formed a view that it was entitled to an outcome of this nature. For example, the head contractor may have made a very good case that under the contract it was entitled to apply damages and delay costs against the subcontractor. In such situations, all the head contractor can do is argue for the amount in question to offset the subcontractors claim.

An adjudication decision, while considered to be interim in nature, can be converted into a judgement of a court of competent jurisdiction. This provides successful claimants with a very quick, simple and cheap means to enforce an adjudication decision.

I hope that I have demonstrated the extent claimants are granted significant statutory advantages in adjudication. In the context of my tennis analogy, claimants are afforded the opportunity to get on the front foot by serving a payment claim. Respondents are always on the back foot defending its payment position.

Despite the clear legislative intent to provide claimants with a ‘leg up’ in terms of getting paid (which I have always supported), right up until 11 March 2020 when the World Health Organisation classified COVID-19 as a pandemic, I always believed that respondents had adequate and reasonable opportunities to defend a payment claim in adjudication.

The way the world is today, I no longer hold this view.

Why have things changed for me?

Since 11 March 2020, we have seen a series of urgent government-mandated health measures designed to prevent or slow the transmission of COVID-19, which in turn has resulted in the economy going into free-fall. One of these measures is the restriction or the prohibition of non-essential gatherings of people.

Has the construction industry been affected by restriction measures?

As at the date of publication of this update, no, construction sites have been classified as an essential service and are allowed to remain open.

What has changed then?

The economy. While the government has now released three stimulus packages, with the most recent being $130b in wage subsidies aimed to prevent millions of people from losing their jobs, it also intends to place businesses into ‘hibernation’.

In an article published by the Courier Mail entitled Coronavirus Australia: Why economy had to hibernate to stop deaths, it is stated:

“On Friday, Prime Minister Scott Morrison announced a plan to “hibernate Australian business” during the COVID-19 crisis, with measures to be put in place to financially protect businesses throughout a shutdown period.”

What does this mean?

In an online article where the Prime Minister is quoted or statements are attributed to him, the following is stated:

“The idea is simple – there are businesses which will have to close their doors. They will have to keep them closed either because we have made it necessary for them to do so, or simply there is just not the business to keep their doors open,” Mr Morrison said.

Mr Morrison said he wanted those businesses “to start again” and he does not “not want over the course of the next six months or as long as it takes, for those businesses to be so saddled by debt, so saddled by rental payments, so saddled by other liabilities that they will not be able to start again on the other side.”

On 31 March 2020, the Treasurer, Josh Frydenberg, told G20 to put the global economy into ‘hibernation’ during the coronavirus crisis. In an ABC online article, it is stated:

“Australia’s own economic hibernation strategy involves $130-billion worth of wage subsidies to try to keep as many people in jobs as possible, even if businesses close for up to six months.”

The most significant government hibernation initiatives are the massive wage subsidies, short term relaxed insolvency laws and relief for commercial tenants.

In summary, in my view the Commonwealth government is implementing these uniquely tailored economy hibernation initiatives because it expects thousands of businesses to become insolvent during this crisis. An insolvent company is one that is unable to pay its debts when they fall due for payment. ‘Bankrupt’ is the equivalent term for a sole trader’s business. This occurs when the business is unable to pay off its debts.

Is it business as usual for adjudication?

In my opinion, adjudication in its current form is not an appropriate dispute resolution process for these unprecedented economic times.

However, I am not proposing that adjudication, like the economy, be put into hibernation. Instead, I am suggesting that adjudication be pared back to a very basic model, suitable for an economy in hibernation.

Nevertheless, even this approach has numerous challenges. For starters, many respondent construction businesses will be insolvent, for at least the duration of this crisis. Therefore, purely from a practical perspective, such businesses will only have a limited capacity to pay an adjudicated amount. The saying ‘you cannot get blood out of a stone’ is very applicable in these circumstances. The tragic thing about this is that most of these insolvent businesses have done nothing wrong. They have been innocent victims of the consequences of COVID-19.

Of course, many claimant construction businesses will be in the same dire financial circumstances, and for them, a key objective in terms of surviving this crisis will be to collect monies owing to them for work carried out.

However, for adjudication to be a just dispute resolution process, as a bare minimum, it must ensure respondents are provided with a fair opportunity to sight a payment claim. There are also other changes I consider necessary for adjudication to remain a suitable dispute resolution option for the duration of this crisis.

Service of adjudication documents is the key issue that must be addressed.

Section 102 of the Building Industry Fairness (Security of Payment) Act 2017 (BIFA) sets out the requirements for the service of notices for adjudication purposes. Essentially, it provides for the service of notices as provided for under the relevant contract or as allowed under section 39 of the Act Interpretation Act 1954. Notably, a service option on a company is its registered office.

In many instances, the registered office of a construction business is its accountant’s office address. It is not unusual for the two businesses to be far apart in terms of distance. While construction sites have remained open during this crisis, the same cannot be said for many businesses like accountants.

I am aware of a regional construction business, recently having a payment claim for a substantial amount of money served at their Brisbane registered office address (Accountants) in respect of a project in another region of Queensland. All previous payment claims had been served by email under the contract.

The accounting business had closed their office as a result of COVID-19 issues but continued operating with staff working remotely. Arrangements were made to collect the mail daily. However, due to attending to urgent matters for other clients, the significance of the payment claim received was not immediately recognised.

Fortunately, the payment claim came to light with a couple of days to spare for the construction business to respond with a payment schedule, resulting in one being produced and served on the claimant.

I am of the view that the claimant in this example attempted to ‘ambush’ the respondent by dramatically changing service of the payment claim to its registered office, in the process, attempting to take advantage of these turbulent times.

If the claimant had been successful with this strategy, the respondent would have most likely suffered a very unfair and unjust outcome.

Why would there have been an unjust outcome?

Subject to the claimant complying with procedural requirements, it would have been highly probable that the respondent would have had a court judgement handed down against them (see sections 78,99 and 100 of BIFA).

What can be done to help in this unprecedented time?

In my view, consideration should be given to the following legislative changes, effective for the duration of this crisis. These suggestions are made considering my experience through the global financial crisis, 13 years as the Adjudication Registrar and 4 years as Compliance Manager for the Building Industry Regulator. As a result, I appreciate the stresses businesses under financial stress suffer, both from a debtor and creditor perspective.

Endorsement

Proposed change: The requirement for payment claims to be endorsed under BIFA.

Businesses are presently operating in a crisis environment. Owners or directors are scrambling to keep their business going. Many are struggling to keep existing contracts progressing, let alone confirm new contacts. Creditors are ringing them, and in turn, they are contacting debtors.

If ever there was a time for a ‘flashing red light’ warning to respondents as to the efficacy of adjudication, it is now in these present chaotic circumstances.

2nd chance

Proposed change: The opportunity for a respondent to provide a 2nd chance payment schedule

This would provide respondents with a further opportunity to provide a payment schedule if they failed to do so in the first instance, purely as a result of being wholly focused on trying to save their business in these unprecedented times. This also will reduce the risk of respondents being served an ‘ambush’ payment claim and being denied an opportunity to respond.

Decisions

Proposed change: No loss of licence for failing to pay adjudicated amount

The Minimum Financial Requirements should not recognise a judgement debt as a result of an unpaid adjudication decision. I do not believe that in the present circumstances when so many government initiatives are being rolled out to save businesses that are insolvent now or will be in future, it is appropriate that an adjudication decision should have the potential to cause the loss of a contractor’s licence.

Stop the Bill

Proposed change: Hold off advancing changes set out in the Bill.

I am of the view that three adjudication initiatives outlined in the Building Industry Fairness (Security of Payment) and Other Legislation Amendment Bill (Bill), should not proceed, namely:

- Making it a requirement that head contractors must provide a supporting statement with every payment claim where they declare all subcontractors have been paid.

- The ability to serve a ‘payment withholding request’ on a party above the respondent (including for a head contractor, a financier) to protect money that may be payable as a result of an adjudication decision, where the adjudicated amount is not paid.

- Allow a head contractor to lodge a statutory charge on property owned by a developer or a related entity of the developer, where the construction work took place, for an amount decided through adjudication, that is unpaid.

Final thoughts.

These are extraordinary times requiring innovative regulatory responses. Given the ‘leg up’ advantages I have outlined that claimants enjoy under adjudication, respondents must have a fair opportunity to sight a payment claim in these turbulent financial times, and then be able to respond. If this very fundamental entitlement cannot be guaranteed, then every subsequent action and outcome, including an adjudication decision, is potentially tainted.

I am also of the view that the simpler we can make adjudication during this crisis, the better for everybody. Back to basics adjudication.

Not intended as legal advice. Read full disclaimer.