Head contractors and principals be warned.

The staged roll out of statutory trusts as a key SOP reform has been a clearly signalled initiative of the government for several years. However, I am aware that many participants in the industry had reservations that statutory trusts would be fully implemented in the manner initially envisaged.

As a result of recent developments, statutory trusts are again flagged to take place on a broad scale, but in a different guise to what was originally intended.

Statutory trusts in the original form of project bank accounts were a key reform contained in Building Industry Fairness (Security of Payment) Act 2017 (BIFA) that became law on 10 November 2017.

On 5 February 2020, the government tabled the Building Industry Fairness (Security of Payment) and Other Legislation Amendment Bill 2020 (Bill) that establishes two new types of statutory trusts, namely project trusts and retention trusts.

So, while the language moves, the concept remains the same. Regardless of whether the original terminology of project bank accounts is used, or the new terminology of project trusts and retention trusts is used, we are still talking about essentially – ringfencing money.

A word of caution for all industry parties. This is a very complicated Bill, and it is not just me saying so. As stated in the Explanatory Notes:

“Complex legislative schemes, such as this one ……………..”

Part 4 of the Bill amends BIFA. Clause 63 of the Bill represents an entire replacement of part 4, chapter 2 of BIFA. There are in excess of 100 sections under this clause. This signifies a major rework of the operations of statutory trusts for the building and construction industry.

The main purpose of this new chapter is to ensure that funds paid to the contracting party, for example, the head contractor for particular contracts, are held in a trust to protect the interests of subcontractors (hence, the ringfenced money concept).

The statutory trust objectives are:

- To ensure that only one project trust account be established by the head contractor for every eligible contract.

- To allow for one retention trust account per contractor or eligible principal to be established to protect retention monies.

- To remove the requirement to establish a disputed funds trust account and instead introduce other protective measures such as the QBCC being able to:

-

- audit trust accounts; and

- ‘freeze’ trust accounts and to give a direction that the trustee gives the Commissioner an account review report.

-

When is a project trust required?

Subject to the staged implementation schedule outlined elsewhere in this article, a project trust will be required for projects where more than 50% of the contract price is for ‘project trust work’ (a new term, see Section 8A) and the contract is $1M or more.

In the Explanatory Notes it is stated:

“Stakeholders raised concern about the proposal to align the various definitions used in the BIF Act and QBCC Act. The definition of ‘building work’ is used to determine the 50 per cent threshold criteria when establishing a project trust. There was consensus amongst stakeholders that the definition must give certainty and clarity for industry. As a result, the definition of ‘building work’ has been renamed to ‘project trust work’ to reflect its specific use in determining if a project trust is required.”

As I am not a lawyer, I will not be expressing personal views on this key definition change under the Bill. However, I have noted in a submission made by the HIA to the parliamentary committee reviewing the Bill, the following relevant statement:

“HIA notes that the Panel Report recommended standardising definitions in an effort to simplify the legislation. HIA supports this approach. One advantage of aligning definitions to existing terms is that there is a body of existing case law that clarifies the meaning of certain terms. HIA encourages the adoption of consistent terms wherever possible. While this has occurred in some cases, for example, with the definition of ‘building’ and ‘building contract’ the approach has not been consistent, for example ‘Project trust work’ is a new term, which is meant to align with ‘building work’ under the QBCC Act but does not.”

The Queensland Major Contractors Association in their submission to the parliamentary committee provided an analysis of additional items they maintain is captured by the definition of ‘project trust work’. In their submission they state:

“These items are (l), (m), (n), (o), (q), (u) and (v). For instance item (q) earthmoving and excavating, in relation to a project for the construction of an airport runway and terminal should not include the earthworks associated with the runway. Item (o) – the erection of scaffolding, should only relate to scaffolding associated with the construction of the building. Item (v) the installation of prefabricated components of a building or other works, is ill defined in respect of other works.”

Project trusts and retention trusts will only have limited application.

It is also important to recognise that project trusts will only be applicable for certain types of projects, a fact that I pointed out in a previous article.

In that article, I made mention of the fact that the government established the Building Industry Fairness Reforms Implementation and Evaluation Panel (Panel) to undertake an evaluation of BIFA. In a report to the government it is stated:

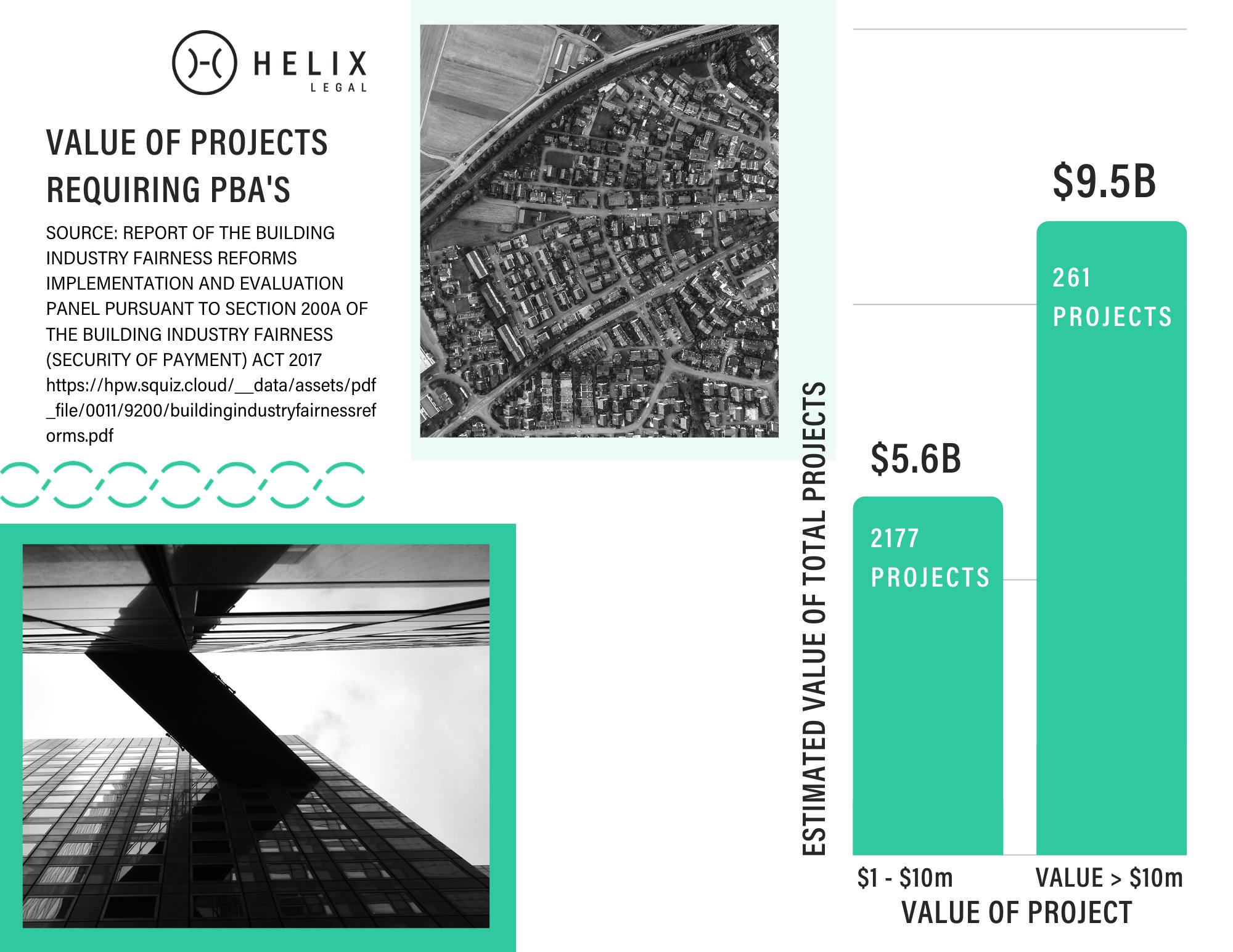

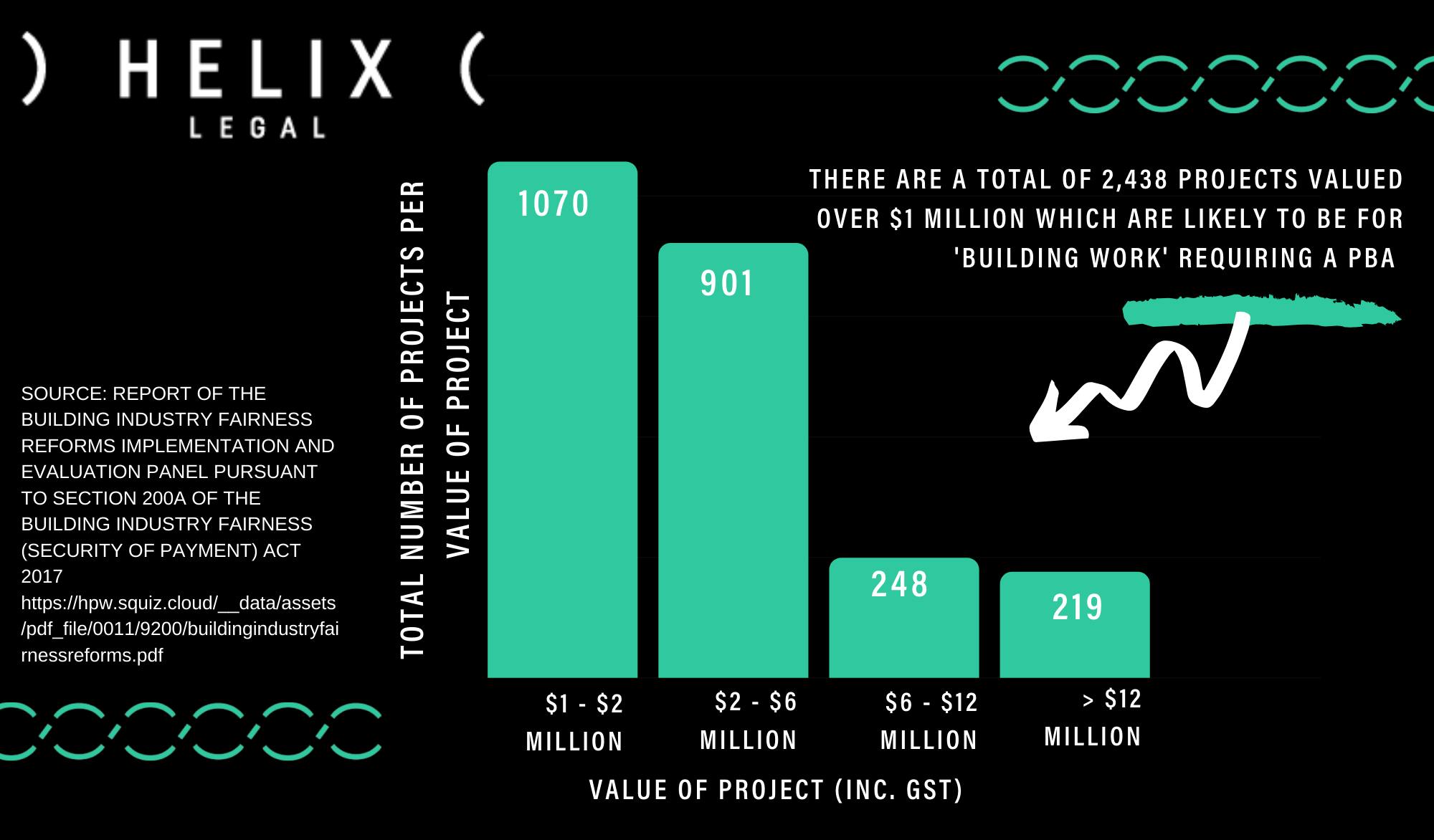

“To assess the number of projects and contractors affected by different options for timing of a phased approach, the Panel sought information from QLeave which is set out in Table 4.”

Based on information from Q Leave, it is indicated in the report that of the $43 billion worth of construction work carried out in Queensland each year, only approximately 35% of that work ($15.1 billion) would require a PBA (which is now known as project trust or retention trust).

The values in my opinion piece dated 4 December 2019 hold true, despite the name changes.

First published 4 December 2019.

It was also projected that a total of 2,438 projects would require a PBA.

First published 4 December 2019.

When is a retention trust required?

As stated in the Explanatory Notes:

“A retention trust account is required when certain criteria of a contract are met, including that the contract or subcontract is one associated with a project trust account. The requirement to have a retention trust account starts when a retention amount is withheld under a contract which meets the criteria.”

In introducing the Bill, the responsible Minister, Mick de Brenni explained things this way:

“If you have a project trust and you withhold cash retentions, you need to establish a retention trust account. Unlike the current framework, where there is one retention trust account per project, new section 34 of the BIF act will provide that a trustee holds all retentions across any number of projects in a single account.”

What are the crucial aspects of the operation of project trusts and retention trusts?

- Key project trust and retentions trust definitions.

- What is a project trust and a retentions trust?

- Who are the trustees and beneficiaries for both?

- When is a project trust and a retentions trust required?

- Contracts that do not require the establishment of a project trust.

- The administration requirements for establishing, operating and ending project trusts and retentions trusts.

- Project trust and retentions trust information-sharing requirements.

- Compulsory training for operating retention trusts.

- Powers, obligations and restrictions for trustees of project trusts and retention trusts.

- Trustees for project trusts and retentions trusts must keep trust records.

- Oversight and operational project trusts and retentions powers of the QBCC Commissioner.

- Project trusts and retentions trusts have the status of a statutory interest to which section 73(2) of the Personal Property Securities ACT 2009 (Cth) applies.

- Project trust and retention trust auditing and reporting requirements.

- Liability of executive officer for offences committed.

What is the implementation schedule for the implementation of project trusts?

In introducing the Bill, the responsible Minister, Mick de Brenni stated:

“The next phase of implementation will commence from 1 July 2020. From this date project trusts will be required on all eligible state government construction projects valued at $1 million or more, including health and hospital services projects. From 1 July 2021 project trusts will be extended into the private sector and to local government. From this date eligible building and construction projects valued at $10 million and above will require project trust accounts.

The requirement for project trusts will then progressively apply to lower value private and local government sector construction contracts and from 1 January 2022 project trust accounts will be required on all eligible projects valued at $3 million or more. Full implementation will be reached from 1 July 2022 when all eligible building projects $1 million or more will be required to establish a project trust account.”

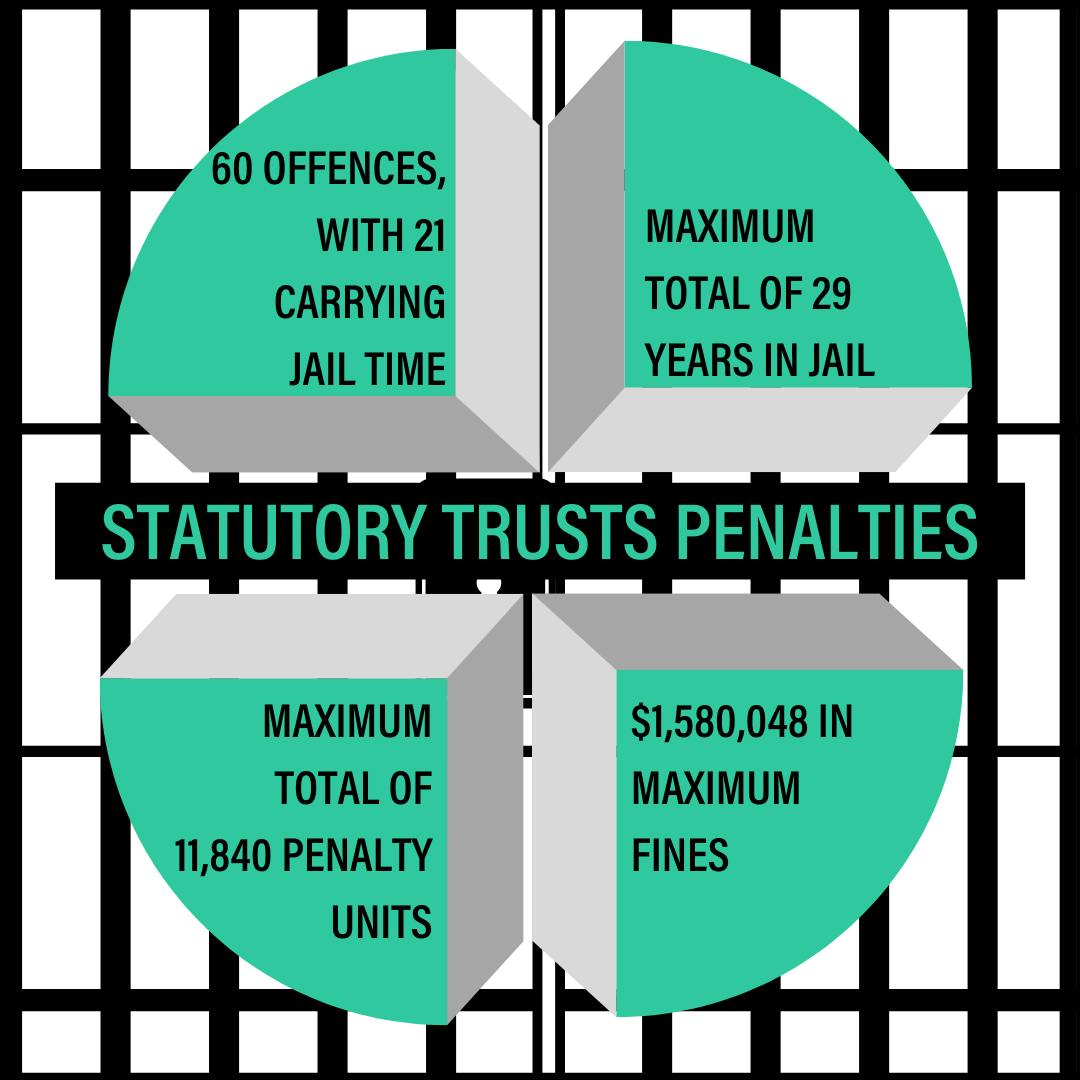

Significant penalties will apply.

The Explanatory Notes for the Bill states that, concerning penalties:

“The Bill replicates several existing BIF Act offences, including the corresponding penalties. High maximum penalties were applied to the BIF Act when it was first made, and it is appropriate that these be retained. The penalties provide strong deterrence from non-compliance, enable the courts to impose more meaningful penalties, such as imprisonment, where appropriate and emphasise to industry and the community the seriousness of the offences under the legislation. New offences associated with the trust account requirements have been based on existing BIF Act offences as well as other trust legislation, including the Legal Profession Act 2007 and Agents Financial Administration Act 2014. The Bill also creates an offence under the BIF Act where a respondent, for a payment claim, pays less than the amount stated in a payment schedule.”

Final thoughts.

I want to stress that the above infographic represents maximum totals in terms of penalty points, jail time and fines. In the Explanatory Notes it is stated:

“Importantly, the penalties in the BIF Act, as well as the remainder in the Bill, are a maximum only and the courts will retain their discretion to impose lesser penalties depending on the circumstances of the breach and mitigating factors.”

I am of the view that the time has come for head contractors and principals to become informed on the operations of project trusts and retention trusts. While there may be some changes to their operations as a result of current deliberations by parliament, I do not expect them to be anything of a major nature.

The parliamentary committee is due to report on the Bill by 20 March 2020. The team at Helix offers a very practical and easy to follow education and training package to help you to prepare for these changes which I believe will shortly become law. Get in touch here if you would like more information.

Not intended as legal advice. Read full disclaimer.