While in this article I make the case that such legislative ambiguity is highly undesirable, with appropriate monitoring of relevant developments parties can take any action necessary to mitigate new identified risks. In other words, the sky is not falling in, and will not in the future if parties stay informed.

After several years operating in respect to Government contracts only, the legislation giving effect to Statutory Trusts, the Building Industry Fairness (Security of Payment) Act 2017 (BIFA), was the subject of very significant amendments in 2020.

There are approximately 130 changed or new Trusts provisions in BIFA.

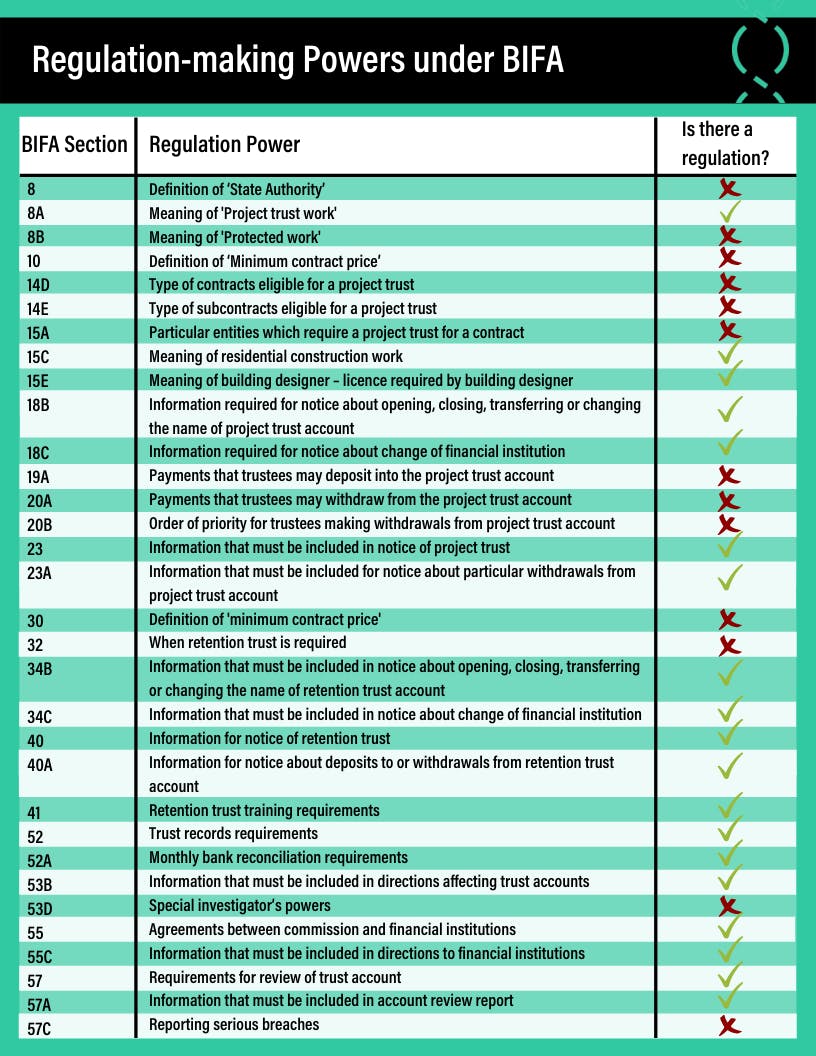

‘New’ BIFA Trusts requirements are also supported by significant regulation-making powers.

I am always uneasy about any piece of legislation that has a lot of regulation-making powers, because it means issues are identified in very broad terms with only scarce details outlined.

In other words, legislative ambiguity.

Trusts legislation ambiguity in BIFA

The ‘new’ BIFA Explanatory Notes gives an excellent example of what I am talking about. It states:

“Complex legislative schemes, such as this one, need to be facilitated by strong regulation-making powers. Not all the powers will be deployed immediately—the intent being to provide flexibility to respond to changes in the industry that may arise following implementation of the reforms.

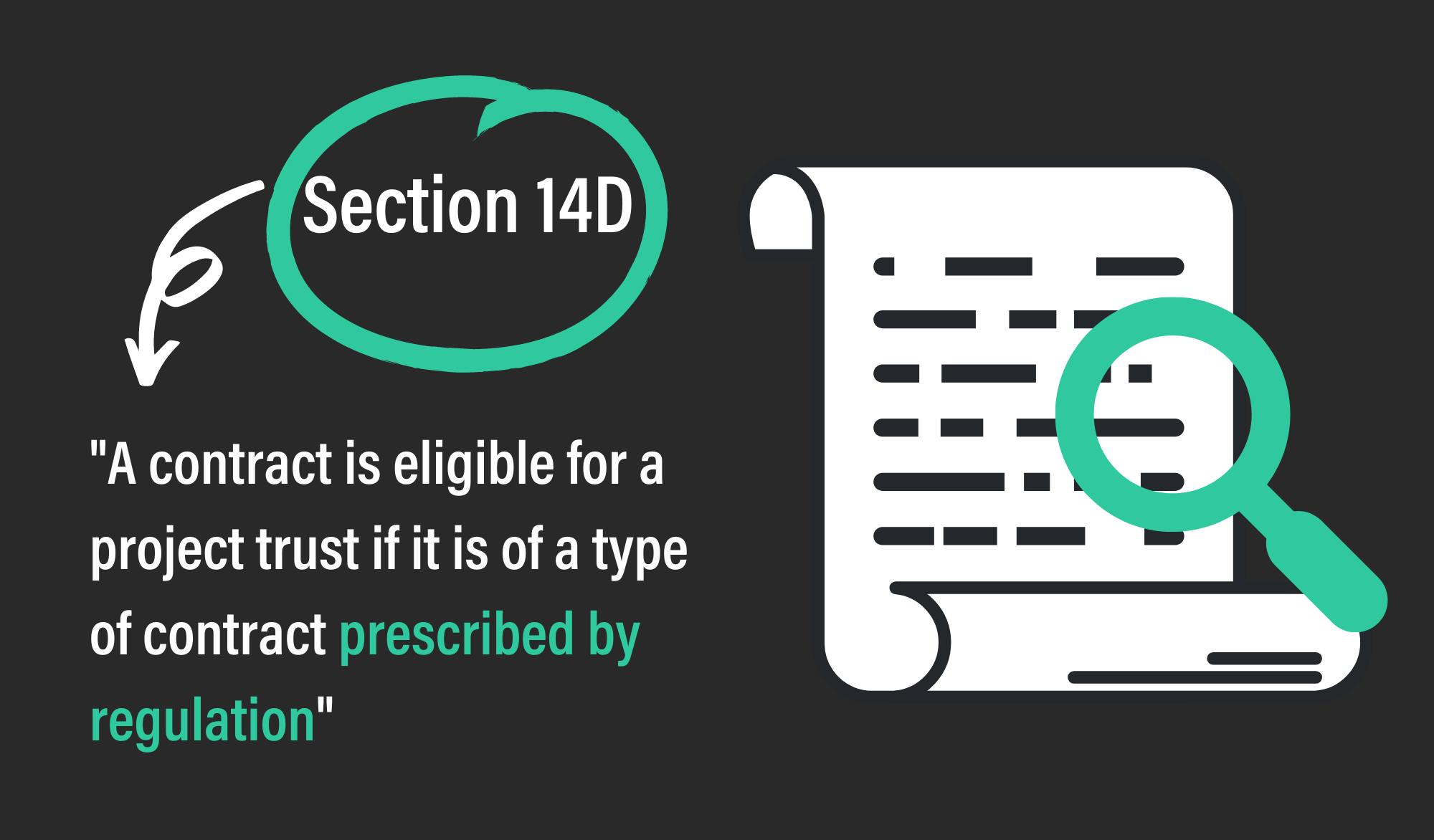

For example, new section 14D of the BIF Act, inserted by clause 63, enables certain subcontracts for which a Project Trust is required to be prescribed. This provision was recommended by the Panel to allow Government to monitor industry practice and address potential contracting practices that seek to undermine the intent of the framework.”

Some Trusts regulation issues are subsequently addressed in the Building Industry Fairness (Security of Payment) Regulation 2018, but the above section 14D example was not in this regulation or any subsequent one.

I can only conclude that to date, no concerning contracting practices (whatever they may be) have been identified. However, along with my Helix colleagues Janelle Kerrisk and David Cahill, we are advising parties daily on their Trusts obligations. Concerning this issue, we are none the wiser.

In my view, the most egregious example of industry parties waiting a long time (4 years plus) to find out details of significant Trusts regulation is identified in a previous article of mine titled Legislative contract reforms are MIA.

I stated in this article:

“To say I am baffled about this outcome would be an understatement.

If one of seven measures to improve SOP was to “create a fairer and more accountable industry” through regulations mandating and prohibiting contract provisions, then I am at a loss to explain why this has not happened.

Having said that, while I can see the good intentions behind such an initiative, I have doubts that any Government can promptly and effectively “respond to rapid changes in Australian contract standards for the building and construction industry”.

I am of the view that Trusts legislation ambiguity is highly undesirable and not fair to impacted parties.

Furthermore, every time I read the BIFA Trusts provisions, I identify potential ‘unintended consequences’. This is hardly surprising given that by the Government’s own admission, this regime is a ‘complex legislative scheme’.

Final Thoughts

While I greatly admire persons working in the Office of the Queensland Parliamentary Counsel and responsible for drafting legislation in QLD, the fact of the matter is that no other jurisdiction in Australia has adopted such a ‘complex legislative scheme’ to address SOP concerns and therefore it would be naïve to think that there would be no ambiguity issues.

Subscribe to David’s Monthly Trust Wrap Up

David Cahill and our Helix Compliance team are all about providing you with the resources and education to navigate Statutory Trusts. To receive free monthly updates on how Trusts are affecting the industry and any tips on how to prepare, SUBSCRIBE BELOW!