The next decade will present countless opportunities for ‘financially fit’ contractors to undertake work associated with the successful Brisbane Olympics win. In this regard, the Minimum Financial Requirements (MFR) for licensing in Queensland provide contractors with a good basis for operating a financially viable business.

While it is true that the MFR presents challenges to contractors, they also provide what the QBCC has judged to be a benchmark of financial performance to allow contractors the opportunity to establish a profitable and viable business.

What do contractors have to gain from being ‘financially fit’?

In response to Brisbane winning the rights to host the 2032 Olympic games, Jon Davies, CEO of the Australian Contractors Association stated:

“The Olympics really gives us the chance to think big and to create a new legacy that will build Queensland’s workforce capability and capacity and innovation.

Let’s set skills legacy targets and unleash innovation so we not only deliver high quality infrastructure but set the construction industry on a more sustainable path.

To realise this opportunity all levels of government need to work together with industry.”

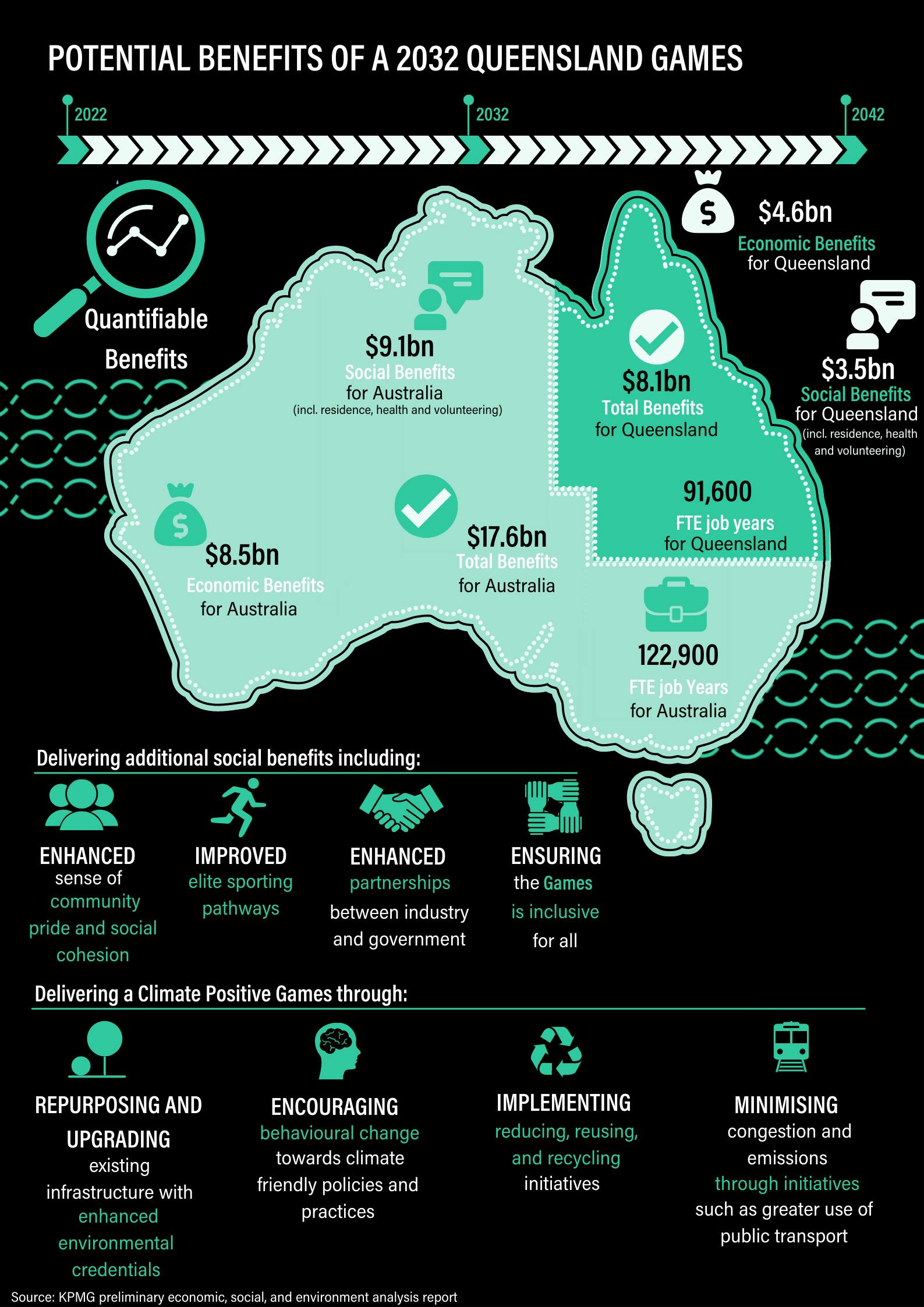

It’s been estimated Australia will see upwards of $17.6 billion of economic and social benefits, with around $8.1 bn of that flowing into Queensland. The 2032 Games are also expected to support 91,600 full-time equivalent jobs in Queensland and 122,900 nationally.

The International Olympic Committee ‘new norm’ policy means the Brisbane Games will fit around Queensland, as 84 per cent of venues are already built or will be temporary. Some current venues like the Gabba will be refurbished to serve while any new infrastructure will have long-lasting community benefits.

An outline of the comprehensive Olympics infrastructure build can be found in an Urban Developer article entitled Brisbane Olympics 2032: Development and Infrastructure Guide.

Read the KPMG preliminary economic, social, and environment analysis report dated June 2021 referred to above here.

David Cahill, Helix Compliance Director comments that:

“Forward thinking businesses of all shapes and sizes will be looking to make their organisation ‘business ready’ for the opportunities ahead: this will include addressing such diverse strands as having the right people, product expansion and upgrading their working capital facilities and equipment.

Interstate (and even overseas) building contractors will be looking at Queensland enviably and considering what they need to do to ‘get a slice of the Olympics pie.

The barriers to entry created by the QBCC licencing system give QLD contractors and subcontractors already licensed an edge in understanding what’s needed to build in the State. They should not lose any time in reassessing whether their QBCC turnover licence level gives them the headroom for expansion in the lead up to the peak of pre-Olympics building activity.”

What are Minimum Financial Requirements (MFR)?

The Minimum Financial Requirements Regulation was introduced on 1 January 2019 to ensure licensed contractors (licensees) are financially sustainable businesses with an appropriate level of working capital. The purpose of the MFR is to reduce the financial failures of licensees.

MFR is the minimum net tangible assets (NTA) and current ratio required to ensure contractors are financially sound and sustainable.

A component of the MFR is for licensees to submit annual financial reporting information to the QBCC. There are exemptions from financial reporting requirements.

There are a number of MFR financial categories that have different requirements.

MFR applied: a perennial challenge for contractors.

In a public announcement on 18 August 2021 by the industry regulator, the QBCC declared an “audit blitz on top builders not paying their subbies”. As a result, builders with a turnover of more than $30 million who have had a monies-owed complaint or adjudication complaint in the past 12 months will be audited by the QBCC.

The QBCC Commissioner said in a media release that the audits would ascertain licensees’ compliance with their obligations under the Building Industry Fairness (Security of Payment) Act (BIF Act).

“The Act requires a person who receives a payment claim to pay the claimed amount in full and on time, or issue a payment schedule.”

“We want to make sure that these debts aren’t potentially an indicator of other financial issues, or of unfair business practices by our biggest licensees.”

Such actions by the QBCC are nothing new and fall within its mandate from Government.

In an article dated 21 March 2019 entitled Laing O’Rourke licence suspension. Lessons Learnt, I outlined 7 lessons learnt as a result of the decision by the QBCC to suspend the licence of Laing O’Rourke.

Changing the application: MFR opportunities for contractors.

For change to happen, contractors will have to shift their mindset from viewing the MFR as a challenge to their business and realise that it also presents an opportunity.

Both these things can be true.

The supporting documentation that is required to accompany an MFR report, in my view, provides contractors with an excellent line of sight or industry benchmark in respect of the financial strength or otherwise of their businesses.

For example:

- “Signed financial statements prepared under the prescribed accounting standards, including:

» a profit and loss statement

» a balance sheet

» an aged debtors and creditors report that includes the date each invoice is due to be paid or received

» a statement of cash flows

» notes to the financial statements

» a declaration signed by the licensee, or an executive officer of the licensee, verifying the information contained in the documents

» a description of the measurement, within the meaning of the prescribed accounting standards, on which the financial statements are based, and the accounting policies or reports relevant to the financial statements

- If the licensee is trustee for a trust, the signed financial statements of the trust

- If the licensee is a partner in a partnership, the signed financial statements of the partnership”

To utilise the MFR to your business’ benefit, in my opinion, you need to fully understand what is required by the MFR and how you can apply it to your business to achieve results. Putting in the work upfront can mean that you are ahead of the game when it comes to bidding for new work, Olympics related projects or otherwise.

If you would like to master the MFR and learn from the experts in the industry who not only know the law but have lived the experience of how it’s applied, check out our MFR Online Course that steps you through the process, mistakes and mishaps; ensuring we deliver practical insights that apply to your business.

Not intended as legal advice. Read full disclaimer.