With the implementation of Statutory Trusts, the question arises: How will the QBCC regulate Trusts? In an article featured in The Australian on 30 December 2021, titled ‘Builders brace for Trust Account rule’, journalist Mackenzie Scott quoted my Helix colleague Janelle Kerrisk saying:

“The regulator has always had powers but this is a new level of being able to freeze the money in these Trust Accounts being able to appoint an investigator to come and look onto things, to ask for the production of documents that they haven’t been able to ask for the production of in the past.”

I agree that, the QBCC now has very significant Trusts oversight responsibilities. This was not the case with the former Project Bank Account regime.

In the Explanatory Notes supporting amendments to the BIFA Act, it is:

How will the QBCC regulate Trusts? What have they published?

The QBCC has produced a Trusts regulatory guide where it is stated that there will be three ways in which non-compliance with SOP obligations are likely to come to the attention of the QBCC, namely:

- “The first is through complaints being made to the QBCC in relation to a contract that requires a Trust Account. On receipt, QBCC will assess the complaint for possible further investigation and action in line with its usual processes. Other relevant notifications of non-compliance to the QBCC (such as money owed complaints or unpaid adjudication amounts) may also trigger an investigation.

- The second way is through the conducting of a proactive audit under an approved audit program. QBCC is developing an approved audit program to check compliance with Trust obligations. The program details, including purpose and timeframes, will be published on the QBCC website once finalised. The QBCC also has the power to appoint a special investigator to investigate a person’s compliance with their statutory requirements in relation to Trust Accounts, and may detect noncompliance as a result of such an investigation.

- The third way non-compliance is likely to be identified is in reviewing account review reports. Account review reports are required to be submitted annually to QBCC for retention Trust Accounts, and may also be required by the QBCC for Project Trust Accounts. An independent auditor will prepare the account review report and is required to report any non-compliance they identify in auditing the Trust Account.

Because there is a possibility that failure to open a Trust Account is more likely in the private sector, the QBCC may direct focused attention to that sector in attempting to detect those contraventions.”

Has the QBCC used these proactive audit powers concerning Statutory Trusts?

Statutory Trusts under chapter 2 of BIFA have progressively been rolled out since March 2021. A section 189 BIFA notice (proactive audit, see the second option above) has recently appeared on the QBCC website.

Head contractors acting as Trustees and who opened a Project Trust Account between 1 March 2021 and June 2021 will be the subject of an audit for one Project Trust Account chosen by them over the period 1 November 2021 to 25 February 2022.

As stated in the notice:

“ The scope of the audit covers compliance with all sections of the BIF Act 2017 that refer to recordkeeping and administration of the Project Trust Account and includes, but not limited to, the following:

- Timeliness of necessary notifications

- Completed bank reconciliations

- Compliance around the administration of the deposits and withdrawals to and from the Trust Account

- Administration of Trust documents compliance.”

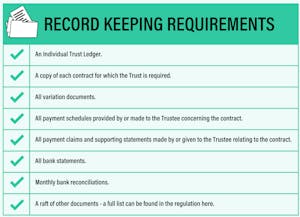

There is a lot for Head Contractors to know as Trustees

Significant records have to be maintained by Head Contractors as Trustees

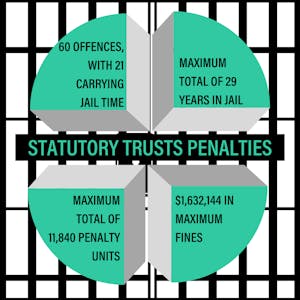

As I stated in a previous article entitled It’s raining penalties for non-compliance with statutory trusts requirements.

The question of how will the QBCC regulate Trusts in the private sector is very much a ‘watch this space’ issue. The QBCC has to decide how long it will initially ‘lightly’ regulate the industry through education and warnings.

When will the QBCC commence prosecuting parties for in their view, willful conduct and/or significant non-compliance causing substantial loss to subcontractors?

Subscribe to David’s Monthly Trust Wrap Up.

David Cahill and our Helix Compliance team are all about providing you with the resources and education to navigate Statutory Trusts. To receive free monthly updates on how Trusts are affecting the industry and any tips on how to prepare, SUBSCRIBE BELOW!