Since the tabling of the Building Industry Fairness (Security of Payment) Bill on 22 August 2017, I have written many articles on the significant SOP reforms contained in this Bill. The center piece of these reforms is the establishment of trust accounts, where progress payments and retentions are held in trust for the protection of subcontractors.

It should be noted that since the tabling of the above Bill, the trusts regime has been the subject of major changes. In two previous articles, I outlined in considerable detail all of the trust changes that have been affected and a very broad outline of the settled legislative requirements and implementation schedule. These articles are:

It’s raining penalties for non-compliance with statutory trusts requirements.

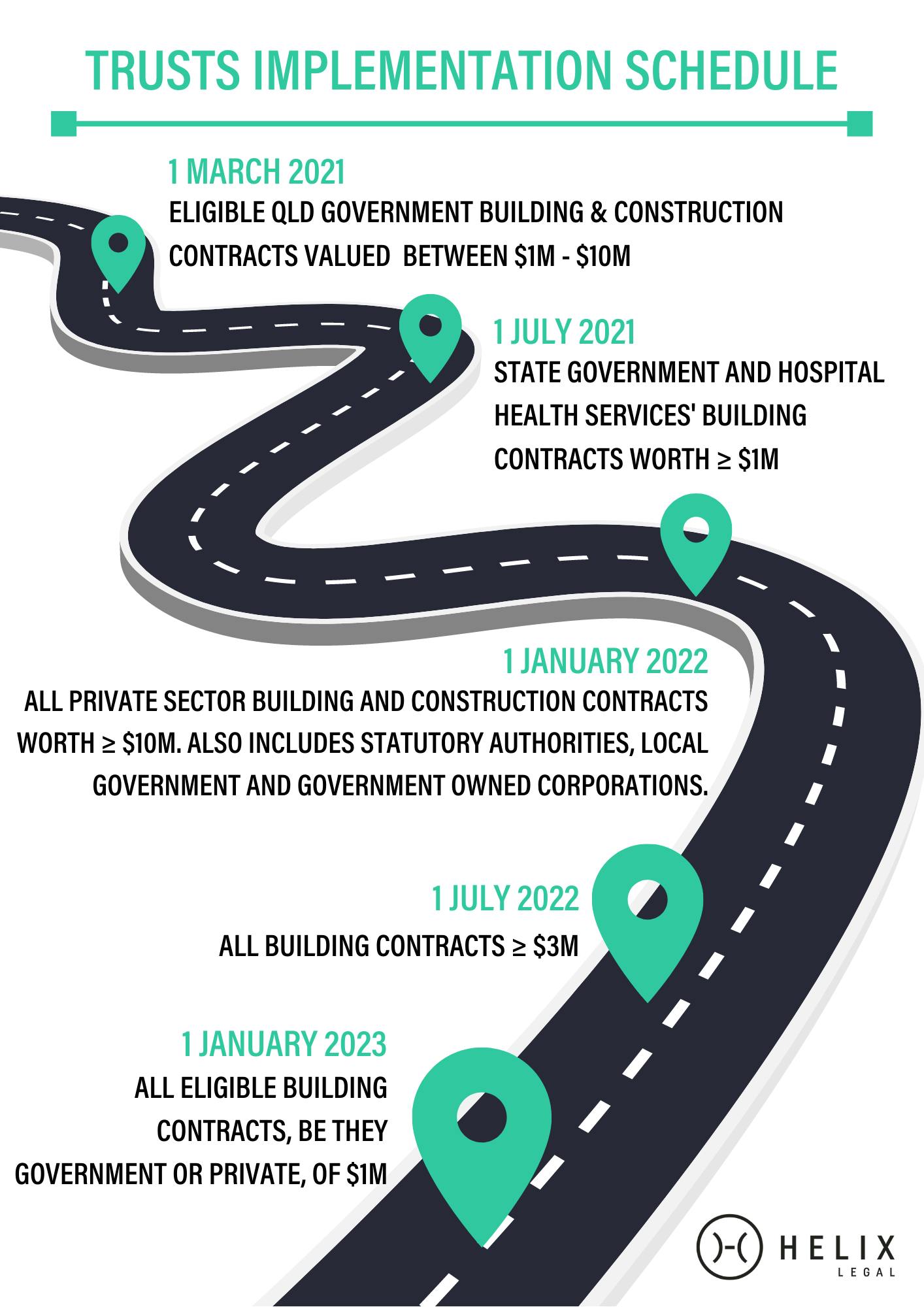

Based on the Building Industry Fairness (Security of Payment) and other Legislative Amendment Act 2020 (BIF Act) now having locked in trusts implementation dates, all affected parties, primarily principals, builders, and subcontractors, must prepare for the impact that these reforms will have on them.

Hear what the Regulator has to say on trusts.

In my first episode of the Build Back Better podcast, I spoke to Kate Raymond, Assistant Commissioner (Service Trade and Regulatory) of the QBCC.

In this short clip, Kate describes the type of work that will and will not be covered by the new project trusts regime to be gradually rolled out from its commencement in March 2021.

You can receive the Build Back Better podcast straight to your inbox by clicking here or you can find it on Apple Podcasts, Spotify, YouTube, and other podcast streaming services here.

Final thoughts.

Anybody reading my previous trust articles will be aware I have highlighted many issues in the spirit of contributing in a positive manner to the development of the BIF Act.

However, I am also a realist and have accepted that this trust regime, in its current form, is a reality. Fighting or agitating for changes is over. Consequently, I feel it is incumbent on me and the Helix team to alert parties to the fact that there is trust train hurtling towards them at breathtaking speed.

The QBCC has produced helpful guidance information on the new trust framework. In the first instance, all affected parties should have a read of this information.

However, like all substantial and far-reaching legislation, until such time as it is fully implemented and ‘tested’ by parties, there are numerous issues which will only be revealed over time.

The actions of the QBCC in these early days of this new trust regime will be crucial in determining the ultimate level of industry compliance.

I am of the view that if the QBCC observes early actions or behavior that is intended to undermine the clear intent of the legislation then perhaps, after a quiet ‘warning shot across the bow’ to the parties concerned, the QBCC will roll up their sleeves and pursue hard cases on unsettled law.

We at Helix have been consulting with a selection of experienced and knowledgeable experts on all aspects of the new trust regime for some time now. Internally, we have workshopped many different scenarios, looking to identify ambiguous issues and any possible ‘unintended consequences’.

As always, I welcome informed comments on significant industry issues and I am interested in hearing the views of others.

Not intended as legal advice. Read full disclaimer.