Main Content

While there is a lot to take in under the new regulations these are our top 10 tips in dealing with the new QMFR:

TIP 1

Do an assessment of your compliance with the MFR before you lodge your Annual Reporting

This is the only way you as a licensee will understand if you are meeting the MFR before the QBCC. You will also understand the likelihood of the QBCC detecting non-compliance and be able to act. This will involve several steps:

- Preparation of financial statements that incorporate the required accounting standards that your accountant would need to sign off in a MFR report.

- Consider any adjustments required under the QMFR that would reduce your net asset position or impact on which assets and liabilities are treated as current or non-current.

- Finalise the assessment of your compliance with the QMFR.

The assessment should be from someone experienced in the QMFR.

Tip 2

Lodge everything required under Annual Reporting

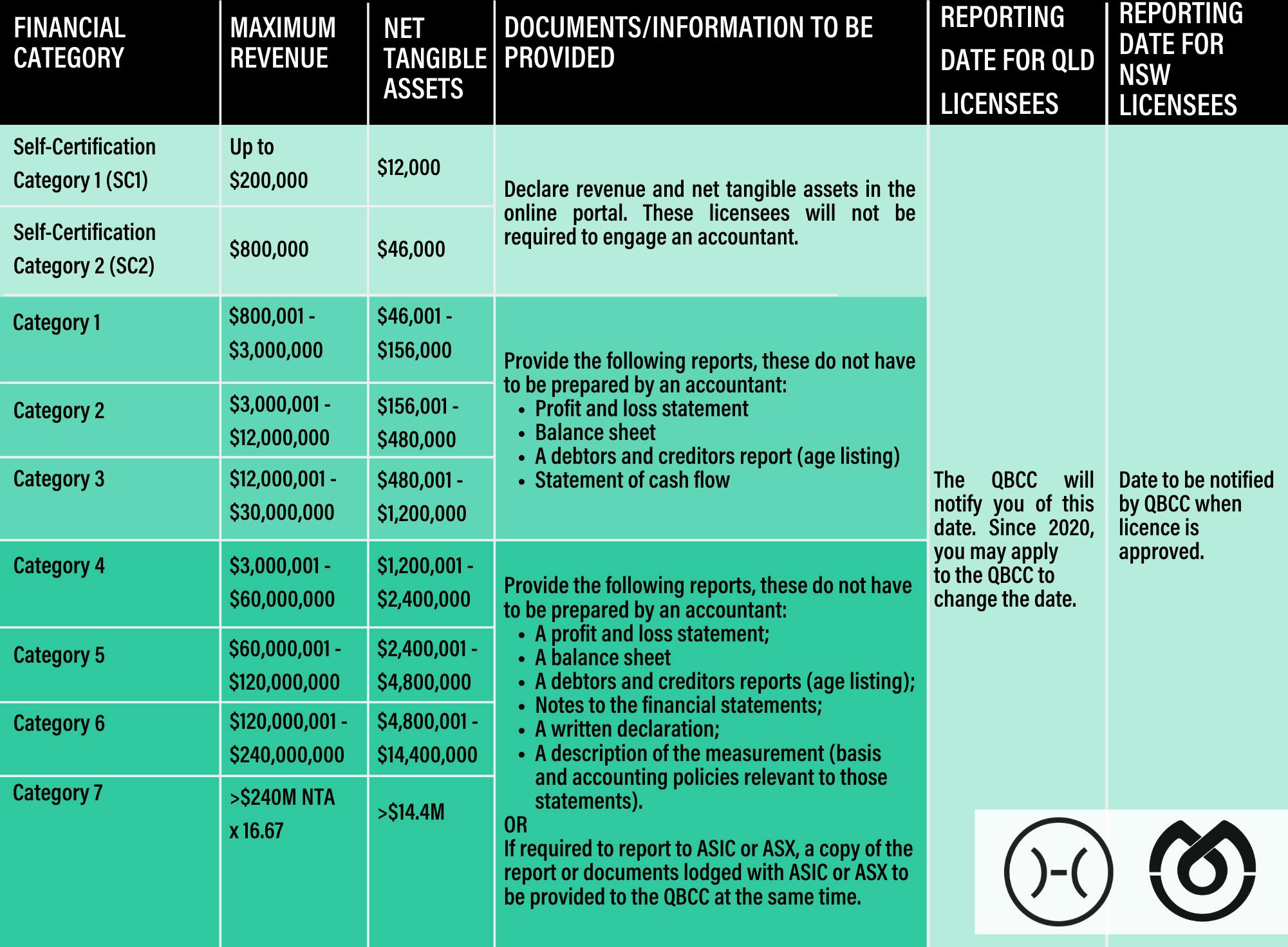

It is insufficient to only lodge the annual financial statements of the licensee. Depending on your licence categoryis the grouping of similar goods or services with common demand drivers and a similar supply base. you will also need to prepare a Statement of Cashflows and provide accounts receivables and payables information, amongst others. Failure to do so may lead to licence cancellation – refer s 9 QMFR and schedule 3 dictionary definitions of “internal management accounts” and “signed financial statements”. The following list on a categoryis the grouping of similar goods or services with common demand drivers and a similar supply base. by categoryis the grouping of similar goods or services with common demand drivers and a similar supply base. basis details what must be provided annually:

Tip 3

Is your structure future fit?

If your structure is making it difficult to pass the QMFR on an ongoing basis, a licensee needs to consider carefully if the structure is still appropriate. You need to act before you have a potentially fatal business disruption caused by a licence suspension.

A good example is the use of trusts, primarily as trust assets cannot be used to meet the net asset requirements, amongst other complications. Refer to Module 1 on structuring of trusts and related party loans under heading “Structuring”.

Tip 4

Ensure you are meeting the MFR on a quarterly basis

A licensee is already required under s 11E QMFR to prepare quarterly management accounts. A prudent licensee would ensure that they are meeting the regulations on an ongoing basis to avoid unexpected difficulties at the time of lodging annual reporting.

Tip 5

Know your Maximum Revenue

This will be a licensees last signed off turnover that they can undertake before having to lodge a new MFR report signed off by an accountant – s 11J and 11L QMFR. Many licensees have been detected under annual reporting whereby they were doing more turnover then their last signed off MFR report or who no longer held the required net assets. You need to know your Maximum Revenue so that you can act before the QBCC does this for you.

Tip 6

Related entity loans

This is one of the most significant changes in the new regulations making it very difficult to treat related entity loans as assets under the QMFR. A licensee should ensure for the most part that they do not have any related party loan assets on their balance sheet. Refer to Module 1 and Module 5.

Tip 7

Get to know the QMFR

Many of the problems that occur come from taking decisions that don’t take account of the regulations. A licensee needs to understand at least the basics of the rules, what are net tangible assets, what are current or non-current assets and liabilities. Some examples we see often are, turning current assets into non-current assets causing the current ratio to be failed. Buying disallowed assets such as intangibles or advancing related party loans that cannot be included as assets.

Tip 8

Do you have a plan B if your licensed entity is no longer meeting the MFR?

This might involve injecting further capital into a licensee, using a deed of assurance or restructuring disallowed assets such as a related entity loan to become compliant again. A licensee should always give thought to what their options might be or what might foreseeably go wrong in the future.

Tip 9

If you aren’t meeting the regulations, then take action to become compliant

Too many times we see licensee’s take no action until it is too late, or the timeframes become extremely difficult to meet. Don’t put your head in the sand. Seek advice and take pro-active action under your own steam where you have more control over the timeframes.

Tip 10

If you hold a SC1 or SC2 categoryis the grouping of similar goods or services with common demand drivers and a similar supply base. licence (up to $800,000 turnover), but don’t trade in your own name, have the licence downgraded to a nominee

Many licensees in this categoryis the grouping of similar goods or services with common demand drivers and a similar supply base. may be retired or only act as nominee for a company, which will mean that you don’t need any ability to do work in your own name. Unfortunately, all SC1 and SC2’s must provide the required financial information under annual reporting or they will be suspended. A very simple option is to reduce your licence class to a “Nominee Supervisor Licence”. In this way, you can still act as a nominee for a company but do not need to provide financial information.