In September 2017, I published an article entitled Is there a safe harbour for a sinking ship? where I noted the passing of the Treasury Laws Amendment (2017 Enterprise Incentives №2) Bill 2017.

The Explanatory Notes for the Bill stated:

“The amendments in Schedule 1, Part 1 of this Bill will create a safe harbour for company directors from personal liability for insolvent trading if the company is undertaking a restructure outside formal insolvency. This will drive cultural change amongst company directors by encouraging them to keep control of their company, engage early with possible insolvency and take reasonable risks to facilitate the company’s recovery instead of simply placing the company prematurely into voluntary administration or liquidation.”

At the time of writing this article, I anticipated that this initiative would result in many directors of financially distressed construction companies successfully restructuring their business under a safe harbour plan.

Hopes dashed

Regrettably, over the following several years, I have not detected any interest in this initiative from financially distressed contractors or their advisors.

Not to be deterred

However, with the advent of this COVID-19 caused recession, I have recently published an article entitled Licensing can assist contractors survive this recession, where I propose the concept of companies forming a safe harbour restructuring plan within the licensing regime.

I have reproduced the relevant parts of the above-mentioned article in full below.

A ‘safe harbour’ applies where directors, believing the company may become or be insolvent, begin creating a course of action that is reasonably likely to lead to an improved outcome for the company than the appointment of an administrator or liquidator. Debts sustained ‘directly or indirectly in connection with that course of action’ are excluded from the directors’ liability for insolvent trading.

Very importantly, directors must be able to show that the course of action employed by the company is reasonably likely to lead to a better outcome than the appointment of an administrator or liquidator. Directors should ensure the intended course of action is in the form of a written plan.

The safe harbour plan should:

-

- include details of the company’s current financial situation;

- contain detail regarding the intended course of action;

- compare the safe harbour outcome to the outcome in an external administration scenario; and

- be supported by legal and accounting advice.

The exclusions from liability for insolvent trading apply only while the safe harbour course of action is being followed. It is in the interests of directors to move to implement a safe harbour plan as soon as the company may be or may become insolvent.

In this regard, recent COVID-19 insolvency amendments will provide some breathing space for directors. I outlined these changes in an article entitled Coronavirus crisis triggers short-term relaxed insolvency laws.

Safe Harbour protections apply until:

-

- the directors or the company stop taking the course of action;

- the course of action stops being reasonably likely to lead to a better outcome; or

- the company goes into administration or liquidation.

I should point out that there are detailed obligations and requirements directors must comply with in establishing, implementing and assessing a safe harbour plan.

Do the MFR accommodate a safe harbour plan?

Under the current Minimum Financial Requirements (MFR) for licensing, I am of the view that a properly developed and implemented safe harbour plan would not satisfy these requirements.

Why?

As I indicated above, directors could seek to develop and implement a safe harbour plan if they believe the company may become or be insolvent.

The problem is that the current MFR are very strict when it comes to matters of an insolvency nature and in my view, cannot accommodate a safe harbour plan.

As I pointed out in an article entitled What’s going to happen now? What financial standards will the QBCC require you to meet post 11 March 2020?:

“There are five main facets of the MFR that contractors must currently fulfil, namely:

-

-

- Have enough Net Tangible Assets (NTA) (calculation of a contractor’s assets minus their liabilities) to warrant a certain level of Maximum Revenue.

- Comply with maximum revenue limitations. This is the amount of revenue a contractor can earn within a year.

- Comply with a current ratio obligation. This is calculated by dividing a contractor’s current assets by current liabilities and must be at least 1:1. According to information on the QBCC website:

-

“a current ratio is worked out by comparing a licensees’ current assets to its current liabilities. This helps to determine the businesses financial viability. Current ratio = current assets/ current liabilities Current ratio must be at least 1:1. For every 1 dollar of current liabilities, you must have at least 1 dollar in current assets. Example: Current ratio = current assets/current liabilities = $52,000 /$30,000 = 1.73:1”

-

-

- Pay all undisputed debts as and when the debts fall.

- Satisfy mandatory annual reporting.

-

Section 35 (3)(a) of the Queensland Building and Construction Act 1991 requires that as a condition on a contractor’s licence, their financial circumstances must always satisfy the MFR.”

Ever the optimist

To be very clear, a company operating under a safe harbour plan would almost certainly not be complying with several MFR facets.

However, this does not necessarily mean that a safe harbour plan could not be successfully implemented within the licensing regime.

In the circumstance where the QBCC identifies a contractor who is not satisfying the MFR, the Commission may suspend or cancel the contractor’s licence under section 48(1)(h) of the QBCC Act. I am no lawyer as I like to point out at every opportunity, but even to me, a may is not a must. Surprisingly, the law agrees with me.

Section 32 CA (1) of the Acts Interpretation Act 1954 states:

“In an Act, the word may, or a similar word or expression, used in relation to a power indicates that the power may be exercised or not exercised, at discretion.”

In other words, the QBCC has discretion as to whether to suspend or cancel a contractor’s licence in these circumstances.

This is a very important thing for contractors to be aware of.

However, directors of a company that hold a contractor’s licence in these circumstances must be proactive and seek expert safe harbour guidance and advice as soon as they identify a risk to the ongoing viability of their business.

If the directors ignore the problem, once the company becomes irretrievably insolvent, they will have no option other than to place it into administration or liquidation.

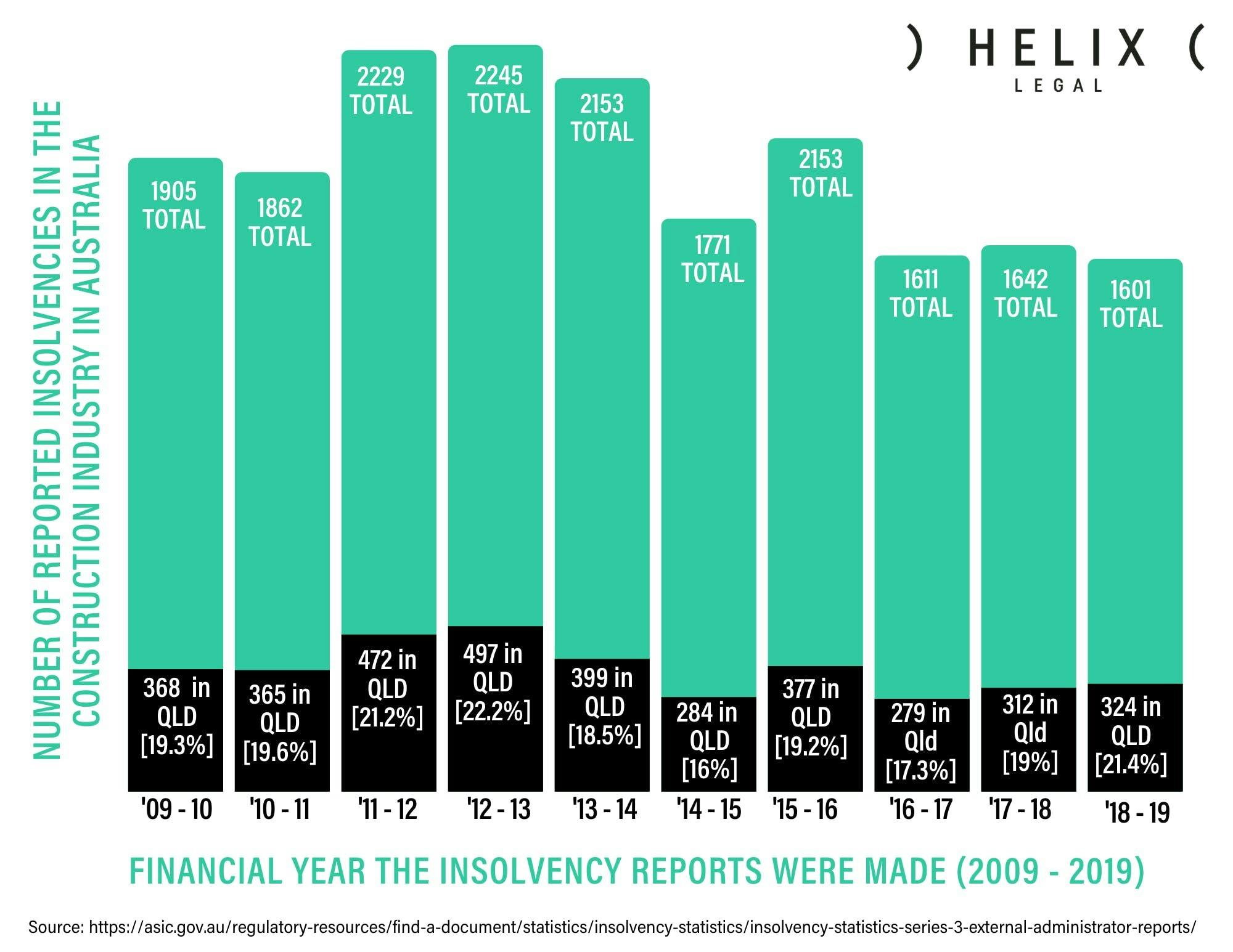

Below is a graph that I have relied on in two recent insolvency-based articles to make the point that over the past decade, there has been no decline in the rate of insolvency in the Queensland construction industry. Indeed, it could be argued that the situation has deteriorated. The articles are:

Economy in recession will cause major insolvency issues for the construction industry.

New measures to address insolvency in the construction industry are urgently required.

In my article entitled Economy in recession will cause major insolvency issues for the construction industry, I noted that these statistics do not include insolvent non-corporations e.g. small sole traders, who have entered into bankruptcy. If bankruptcies of this nature were added to corporate insolvencies, there is no doubt the construction insolvency statistics would be even more alarming.

I am of the view that we must look to adopt new ideas and concepts to address the blight of insolvency in the industry. In this regard, I acknowledge that the concept of forming a safe harbour restructuring plan within the licensing regime represents ‘out of the box’ thinking.

However, I believe that with the support of experienced and suitably qualified advisors, in certain circumstances, a financially distressed construction company could successfully recover by way of a safe harbour plan.

In closing, I would like to invite interested persons to join me on Wednesday 24 June 2020, at 4 pm, when as part of the Helix Essential Series, I will be chatting to Claire Packer, Managing Director, Corporate Finance and Restructuring of FTI Consulting on all things relating to insolvency in the construction industry.

Not intended as legal advice. Read full disclaimer.