I believe that SOP for parties working in the construction industry will only be achieved through a sustainable industry.

What is SOP – security of payment?

What is Sustainability?

The Australian Contractors Association (ACA) has identified three pillars essential to supporting a sustainable construction industry, which I support:

The infographic above is displayed on page 8 of the ACA’s Report entitled “Constructing the Future. A framework for a more sustainable construction industry.”

The quote from the ACA below is from page 7 of the same Report.

On 6 September 2020, Jon Davies, CEO of the ACA, joined us for the Helix Essential Series. In this video, Jon spoke about a number of key initiatives that ACA were implementing. The initiatives were to identify issues in the industry and provide recommendations on how each issue should be addressed.

The ACA Report says on page 9 that:

“In order to achieve true value, leverage community benefits, reduce the prevalence of disputes and provide a platform for investment, project commercial frameworks need to align the interests of all parties to the greatest extent possible and be drafted to achieve best for project outcomes rather than favouring any one particular stakeholder.”

The ACA Report also highlights on page 4 that “The construction industry currently has the highest number of insolvencies of any major industry sector in Australia” and refers several times to the imbalance of risk in our industry which inevitably results in an unfair distribution of the rewards for bearing that risk.

Consider two very well-respected, large players in the property development and construction industries: Stockland and Hutchinson Builders.

In 2019 and 2020, both of these well respected and professional businesses achieved the same revenue of between $2.9 billion and $3.0 billion for both years. Stockland reported a net income of $640 million and $660 million respectively. Hutchinson, by contrast, reported net income of $11 million for both years.

To put this disparity into context, it is equivalent to two subcontractors with revenue of $10 million each with one returning net income of $2.2 million and the other of just $40,000.

Whilst this comparison may easily be called out as unfair based only on a sample of 2 businesses, it serves to highlight the pressures on contractors – both large and small – by the inequitable commercial frameworks prevalent in the Australian construction sector.

Consider this in the context of Queensland’s most recent SOP initiatives.

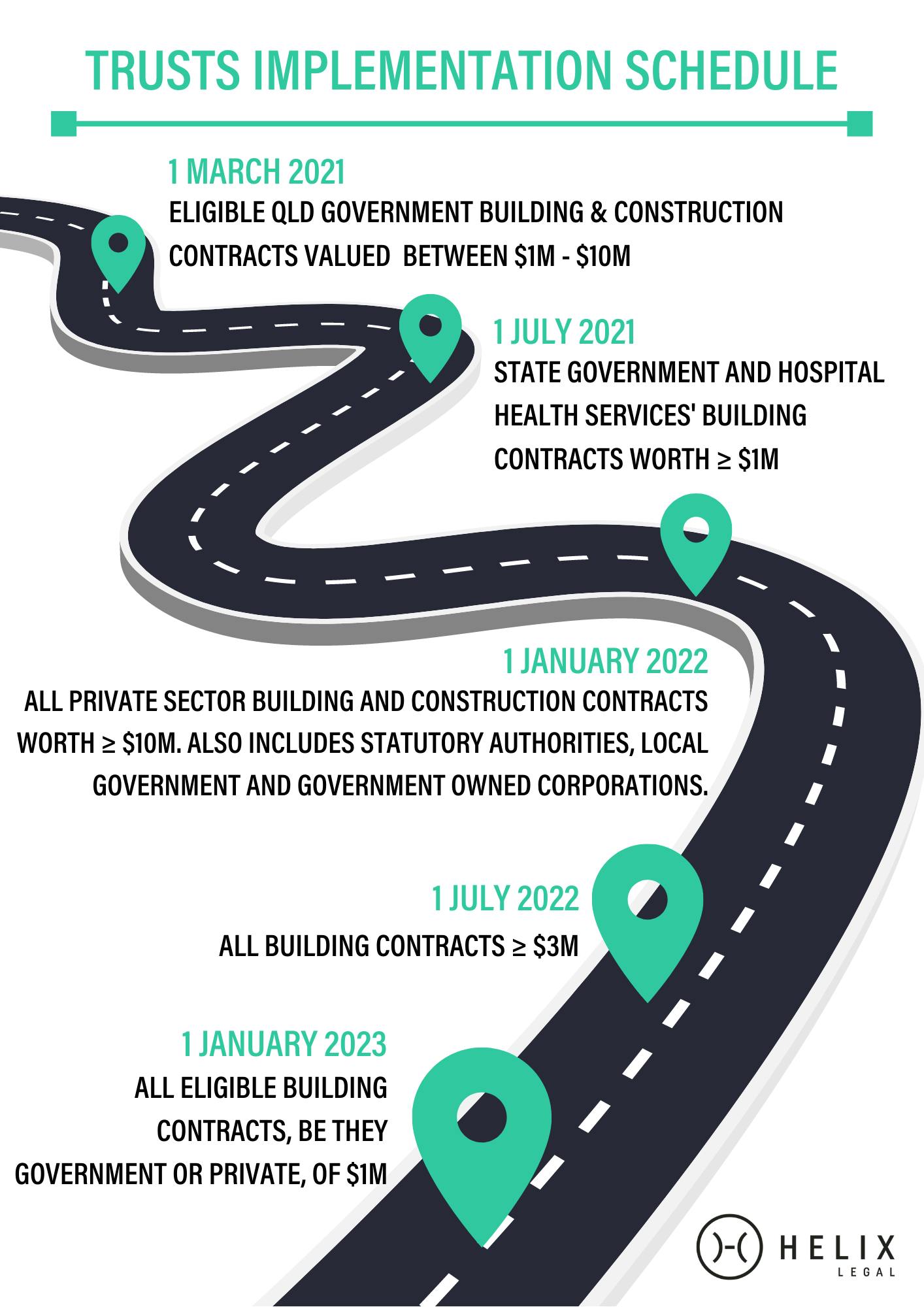

Since the tabling of the Building Industry Fairness (Security of Payment) Bill on 22 August 2017, I have written many articles on the significant SOP reforms contained in this Bill. The centerpiece of these reforms is the establishment of trust accounts, where progress payments and retentions are held in trust for the protection of subcontractors.

It should be noted that since the tabling of the above Bill, the trusts regime has been the subject of major changes. In three previous articles, I outlined in considerable detail all of the trust changes that have been affected and a very broad outline of the settled legislative requirements and implementation schedule. These articles are:

- It’s raining penalties for non-compliance with statutory trusts requirements.

- It’s a matter of trust

- Trusts will jolt the construction industry to its foundation. Are you ready?

The Building Industry Fairness (Security of Payment) and other Legislative Amendment Act 2020 (BIF Act) is the enabling legislation for statutory trusts.

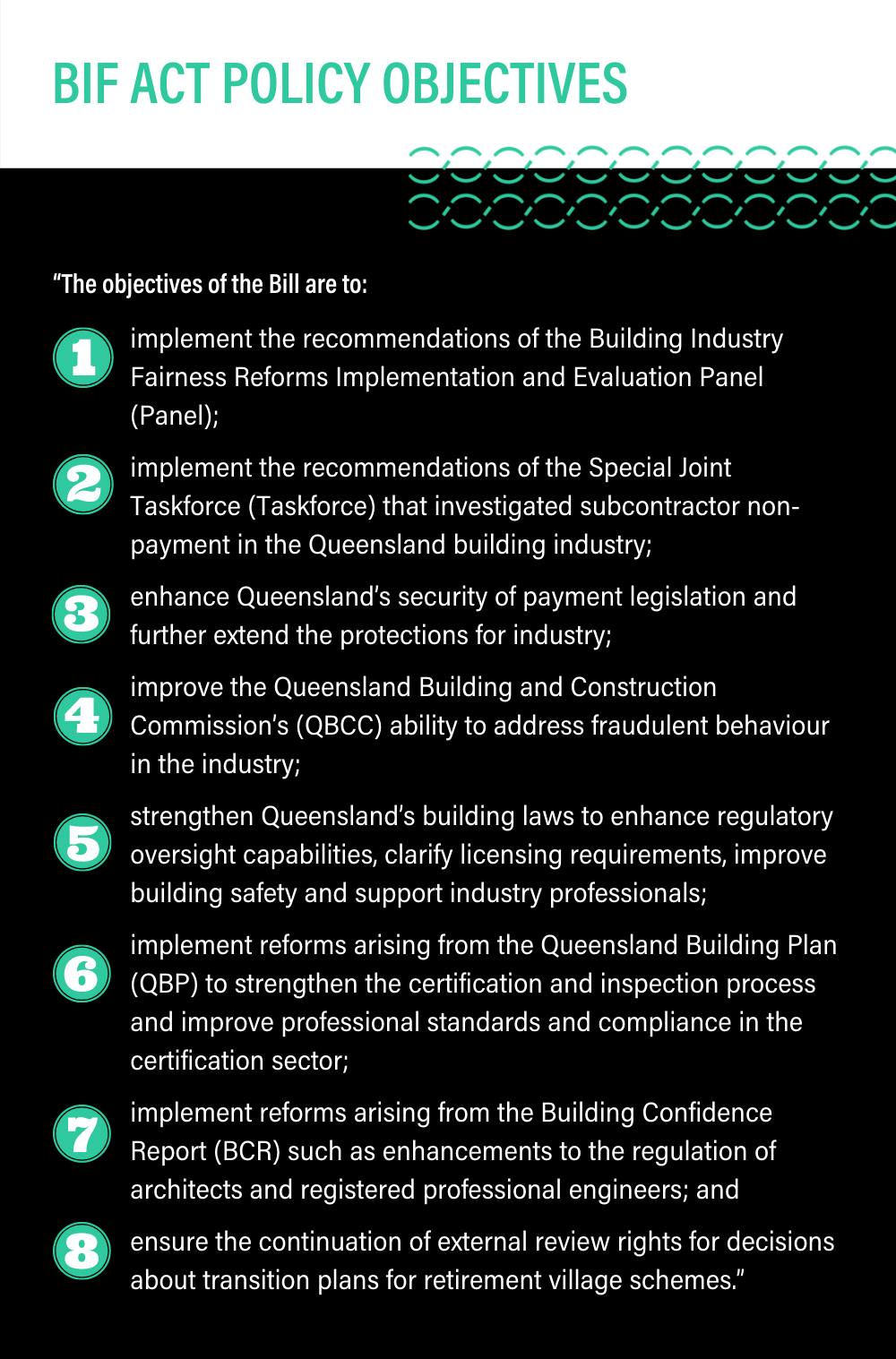

What are the BIF Act policy objectives?

The explanatory notes for the BIF Act are very detailed and explicit concerning the policy objectives and the reasons for them. It is stated:

As is evident from the Explanatory Notes for the BIF Act, there is no mention of these initiatives working towards improved sustainability for all parties in the industry.

Furthermore, in all my research on the development of the BIF Act, including but not limited to reports, second reading speech and explanatory notes, I have not identified any modelling undertaken on the prospects of the above-stated objectives delivering sustainability for all parties.

In my opinion, it is time to make sustainability part of the conversation. If not, we face a decade ahead of higher costs for building contractors, a huge squeeze on their working capital and profitability, and perhaps, worst of all, no new entrants into the industry.

What does sustainability have to do with SOP?

I am very strongly of the view that true SOP (security of payment not a piece of legislation) for people can only be delivered through a sustainable construction industry.

If we focus on sustainability we can achieve a future where, for example, the adjudication process, where there is only one winner, becomes obsolete.

However, I should point out that although there was not an apparent razor-sharp focus on industry sustainability in the development of the BIF Act, this still could be a consequence of these most recent reforms.

Only after a detailed and meaningful analysis of the impact of these reforms when they have been fully implemented for some time, will we have a sense of the impact on sustainability.

The traditionally adversarial nature of the construction industry was a major reason why adjudication based SOP reforms were first introduced into Queensland. When I provided the initial drafting instructions in 2003 for legislation of this nature, the construction industry was facing the same challenges as it is today.

In the past 18 years, the world has moved on and I for one hold high hopes of more fair and aligned commercial frameworks operating in the industry.

I would like to see all parties working in the construction industry, particularly developers and subcontractors, think about what sustainability looks like for them in the future.

I invite all parties working in the industry to walk and chew gum at the same time so that the immediate challenges of the present are addressed at the same time as looking towards a better and more sustainable future.

Presently my number one priority is providing relevant and helpful information to industry parties on the implementation of Trusts.

Final thoughts.

Project Trusts and Retention Trusts are a reality.

I am surprised and concerned at the number of meetings I am walking into where contractors are operating under the illusion that trusts are not going to happen or don’t apply to them.

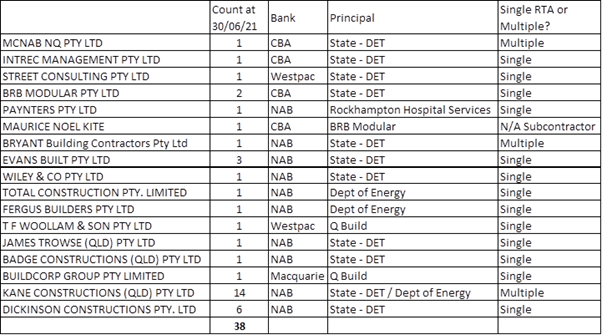

As at the end of the financial year there were 38 significant projects registered on the QBCC Trust Account Register:

- Kane Constructions has 14 projects registered;

- 17 separate Builders have registered under Stage 1 of the Trusts rollout;

- NAB is the bank for 9 out of the 17 Builders;

- CBA in the bank for 4 of the 17 Builders; and

- 2 Builders are using multiple Retention Trust accounts instead of the single account envisaged by the QBCC.

These are the vanguard of builders having to get their heads around the administrative burden and feeling the immediate effects on their working capital – for me, by far the least understood aspect of Project Trusts.

Builders are a tenacious and hardworking bunch but this mountain isn’t one you want to tackle alone – talk to your accountant, begin a conversation inside your business and, as always, Helix is here to help you navigate your way.

Are you a QBCC licensee that will have to establish Trusts?

We’ve developed a quick and easy to use tool to let you know if and when your business will be affected by the new Trusts regime, give it a try.