Denying the reality of Statutory Trusts in the construction industry is like rejecting the existence of climate change.

While I am always respectful of other peoples opinions, I believe that climate change is a fact and that urgent action is needed to address its impacts.

However, I am aware that there are people who are not persuaded about climate change, who question the need for any action and advance an agenda that can be best summed up as:

Climate change is not happening.

Need to do nothing.

Ignore all pesky chatter of a contrary nature.

Everybody just needs to carry on living as usual.

I am aware of parties impacted by statutory trusts in the industry who believe that:

Trusts are not going to be of concern to me.

Need to do nothing.

Just ignore all annoying talk to the contrary.

It’s business as usual.

To date, trusts only apply to eligible government contacts, but on 1 January 2022, the rollout will be expanded to also capture all eligible private sector contracts worth > $10M.

During 2020, on a staged basis, more and more eligible private sector contracts will be captured.

The Queensland Government advised us by way of two proclamations (27 and 28 August 2020), that the statutory trusts regime will be implemented as outlined above.

In other words, on the date of publishing this article, the commencement provisions applying to trusts have been fixed by these two proclamations.

Key changes to complex trusts legislation have caused parties to be confused.

Wait, is it that complex?

Yes!! This is what is stated in that regard in the relevant Explanatory Notes:

“Complex legislative schemes, such as this one ……………..”

When any government tells you a piece of legislation is complex, you better believe it!!

The legislation giving effect to trusts, the Building Industry Fairness (Security of Payment) Act 2017 (BIFA), was the subject of very significant amendments in 2020 after several years of the operations of ‘Project Trust Accounts’ in the government sector.

I am of the view that everything parties may have understood about the operations of trusts under this ‘Project Trusts Accounts’ regime should be expunged from their memories because the current trusts regime bears next to no resemblance to it.

Unfortunately, I also believe that the magnitude of these changes has not yet been grasped by many parties. There are approximately 130 changed or new trusts provisions in BIFA.

Furthermore, it is my view that there are regrettably some parties who while they appreciate the significance of these changes just want to pull the doona up over their head and hope that mysterious trusts will just disappear.

The current trusts regime is complex, with many compliance and enforcement risks to impact parties.

In seven previous articles, I outlined in considerable detail all of the trust changes that have been affected and a broad outline of the settled current legislative requirements and implementation schedule. These articles are:

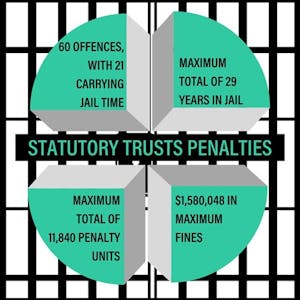

- It’s raining penalties for non-compliance with statutory trusts requirements.

- It’s a matter of trust

- Trusts are a reality. Affected parties need to take note!

- Trusts will jolt the construction industry to its foundation. Are you ready?

- Are developers now off the hook?

- Parties don’t know what they don’t know concerning trusts

- Are Trusts the cure?

Moreover, my fellow Helix Compliance Director, David Cahill in an excellent article entitled Cash is king in the construction industry, stated:

“While many people had concerns about Head Contractors being able to use subcontractor cash retentions as part of their day to day working capital, the enactment of the Building Industry Fairness (Security of Payment) Act 2017 (BIF Act) now means that this cash must be separated out of Head Contractors’ liquidity and held separately in Retention Trust Accounts (RTA).

Under the BIF Act, that is designed to protect payments for subcontractors working on building and construction projects in Queensland, two types of trust accounts may be required if certain contract and other conditions are met:

- one Project Trust Account (PTA) per eligible project; and

- one RTA (if applicable) to hold cash retentions across multiple projects and subcontracts.

The Retention Trust reforms mean that Head Contractors, on a staged basis over the next 15 to 18 months, will be unable to use cash retentions in their business cash flow.”

I have spent every day of my working life interpreting legislation as a non-lawyer and breaking down its potential impact for parties who have obligations, responsibilities, or rights in an easily understood but correct manner.

Over this period I would have undertaken this process thousands of times concerning hundreds of pieces of legislation.

This current trusts regime is the most challenging piece of legislation I have ever encountered in providing this manner of assistance to parties, but I am gradually winning!

Compliance and enforcement risks.

As the inaugural Compliance Manager for QBSA, the predecessor for the QBCC, I look at the powers conferred on the QBCC to enforce this trusts regime with a mixture of astonishment and apprehension. At the same time, I am acknowledging the need for a complex scheme of this nature to feature some ‘big stick’ consequences for parties non-compliance with their obligations and responsibilities.

I have read all parliamentary speeches made by the responsible Minister in respect of BIFA, the accompanying explanatory notes and every relevant document published by the QBCC. I look at all this information from the perspective of being the person required to develop a trusts compliance and enforcement strategy.

There are several key pointers in terms of what parties can expect from the QBCC in enforcing these trust requirements.

Firstly, in Explanatory Notes supporting the 2020 amendments to BIFA, it is stated:

Secondly, the same Explanatory Notes state:

“The Bill replicates several existing BIF Act offences, including the corresponding penalties. High maximum penalties were applied to the BIF Act when it was first made, and it is appropriate that these be retained. The penalties provide strong deterrence from non-compliance, enable the courts to impose more meaningful penalties, such as imprisonment, where appropriate and emphasise to industry and the community the seriousness of the offences under the legislation. New offences associated with the trust account requirements have been based on existing BIF Act offences as well as other trust legislation, including the Legal Profession Act 2007 and Agents Financial Administration Act 2014.”

Want to know more?

You are invited to come along to our upcoming event and hear from the Directors of Helix Compliance Solutions Pty Ltd, namely Janelle Kerrisk, David Cahill and myself talk about all things to do with trusts. I can guarantee you that you will get none of the old section so and so says blah because we know you can read.

What we will tell you is all that we have learnt in the 6 months of intensely studying the trusts regime, what we know about running accounts, what we predict is on the horizon for the new year and how you can get your ducks in a row to turn a curse into a cure.

Date: Wednesday 1 December 2021

Time: 5:30 pm

Location: The Precinct, 2/315 Brunswick Street, Fortitude Valley

To purchase your ticket and secure yourself a spot, click the link here. Get in quick!!

Our Compliance expert David Cahill has also started a monthly update mailing list that gives you the inside scoop and updates around the implementation of Project Trust Accounts, who is currently operating them and what effect it will have on your business in the new year. To learn more about the monthly updates click here or fill in the form below to subscribe.

We would love to keep you informed and educated on all things trust!